Elgitread is all about retreading. Retreading equipment, retreading material, retreading equipment and retreading tools. And if you are as stumped as I am, the company has been gracious enough to explain dummies like myself what retreading is.

My first impression of the company, was a capital intensive industry with single digit NPMs but the 11%+ NPM got me looking. Rising sales and profits over the last 5 years (although 2004-05 was a bit weaker in the OPAT area which would explain the lower dividend payout that year)

The financial are enclosed -

Share capital - 4.28 crs

Face Value - 1 rupee per share

Loans - o.oo crs (debt free)

Investments - 40.39 crs

Net curr assets - 63.62 crs

Dividend - 0.60 rupees per share

CMP - 42.75 rupees (27-Jan)

Notes -

1. The NCAV per share is 14.86 rupees which is just 1/3rd of the CMP. A secondary cushion is provided by investments

2. Investments are at 9.44 rupees per share. However, not all of this 9.44 is under quoted investments. Upon examination of the annual report 2003-04 (couldn't find 2004-05 report), I find that 153,907,849 rupees is under quoted investments i.e. 3.60 rupees/share. That would make our NCAV (incl invt) equal 18.46

3. Dividend yield is at 1.40% which is again low.

4. P/E (LY) is at 13. 54 and although Q1 and Q2 have been a dash better, its not something very commendable.

5. Debt recapitalisaition is also not very strong. It sums up to 33.78 crs which is 0.16 of m-cap.

Retreading is a growing business in many countries esp. China, Russia and India. Although the financial donot support a confident buy, keep an eye for this stock. You might be tempted to buy the stock in a smaller quantity and increase intake once the price reduces.

Sunday, January 29, 2006

Elgitread India

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, January 28, 2006

Every investor should read this

It's called "Seven Secrets of the Investing Masters". Read, re-read the text because it gives you a wonderful glimpse of how the worlds best investors have earned their wealth from investing, from trading, getting rich overnight and other strategies/tactics.

The article features -

1. Benjamin Graham

2. Warren Buffett

3. Peter Lynch

4. Anthony Gray

5. George Soros

6. Jim Slater

7. Anthony Bolton

I am reminded of Charlie Munger, who has often related investing with psychology. It's often called the madness of the crowd. Please find enclosed a most fantastic text - Extraordinary Popular Delusions and the Madness of the Crowds by Charles Mckay which'll help you understand bubbles. Since the text is too long, sincerely request all to definitely read the chapters on the South Sea Bubble and the Tulipomania.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, January 18, 2006

Bhagyanagar Metals

The last time I told someone about this stock, he quirked a remark - "Yeh stock lo, aur Bhagya pe chod do" ("Buy this stock, and leave it to destiny"; bhagya in hindi means destiny). As destiny would have had it, this is one stock which can fit the Graham radar. Please explore the enclosed stats -

Share capital - 6.3 crs

Loans - 14.47 crs

Investments - 1.6 crs

Net CA - 70.13 crs (22.2 rupees per share)

FV per share - 2.00 rupees

Dividend per share - 0.5 rupees

CMP = 30.20 rupees

Observations -

1. NCAV (Net Current Asset Value, net of all debt) comes to 17.66 rupees per share (0.56 times of CMP)

2. Dividend payouts for last 5 years (avg payout being 15%) have been good. The cash available is 2.71 per share so another payout of 0.5 rupees is defintely on (maybe more).

3. Debt recapitalisation (on an interest coverage of 4) is a cool 67.4 crs. The m-cap is 108 crs which makes me very comfortable.

4. The company works on a P/E ratio of 3.51

5. Growing sales and profits for last 3 years.

Some things to look out for - 1. The company is trying to work on a restructuring plan - a possible demerger; 2. Promoters are buying shares - a possible buy-back; 3. The quaterly results over the last one year have many an ups and downs - ???

I would suggest a buy for this stock. And be vary of the news on demerger, this may create opportunities in the pricing and valuation of the business.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, January 15, 2006

Bimetal Bearings

Bimetal Bearings would faintly fit in a Grahamian definition of a value stock. It has some unique features which makes the stock very enticing. Bimetal Bearings is a small-cap company with the following stats -

Outstanding shares - 0.33 crores

Loans (secured and unsecured) - 1.53 crores

Investments - 28.03 crores

Net CA - 37.14 crores

Face Value - 10 rupees

LY dividend - 6.25

CMP - 286 rupees

PAT - 10.98 crores

Lets examine this company using our principles of value investing and other derived techniques

a) Graham puts good focus on the net CA per share. In this case we are looking at 109 rupees per share. This is much lower than the CMP of the scrip (albeit a very good number when compared to most other stocks in the Sensex). We need cushion.

b) Investments are at 28.03 crores. If the investments are of a quantifiable and liquid nature then we should go for it. Unfortunately I was not able to locate the website of the company and hence couldn't go through the balance sheet. At liquid investments, the contribution of investments to the value of the company is 73.18 rupees. Being conservative, I'll take only 50% of this amount i.e. 47 rupees to our calculation. Thus, we have a net NCA (incl invt) of 156 rupees (109+47).

c) Bimetal Bearing has been giving positive profits for the last 5 years in a row. Sales have been increasing on an year-on-year basis for the last 4 years albeit at a slow pace of 10%.

d) The company has been giving dividend for the last 5 year. The last two yrs, the dividend ratio has been a healthy 6.00% and 6.25%. Two things are important here - the dividend yeild and the ability of the company to give the same or more dividend. Firstly, the dividend yeild would come 2.18% which is rather low (a risk free bond would give 5.5% over a one-year period). Secondly, the quarterly results indicate that PAT will close at the same levels as last year, so we can expect a similar dividend payout. I am doubly confident of a similar payout of dividend as the company has a good 22.1 rupees of cash in hand in it's books. So 6.25 rupees should not be dificult.

The company is a safe bet and I cant see too much of a roll down from current levels. I would recommend a small investment in the company and buy further on declines. Donot have too much of exposure in the company. I will have a further update on the company in another 2 quarters.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, January 12, 2006

He wants stock "tips"

Mohit had recently posted a comment in one of my previous blog with a suggestion for me to start posting some stock related pieces. So let me try my hand in proposing some stocks to invest in. But there are some rules - a) All stocks suggested will be based on the principles of value investing and b) all investors who consider the advice must use their own research before ariving at the final decision.

I would attempt to take this blog to be an investor's shack where all can sip a brew of value investing and run down numbers and suggestions to grow the network. True to self, I would still take time to put down some very relevant insights that are listed in some of the great books of our time. (I have started reading "The Intelligent Investor" by Benjamin Graham)

So sit back and enjoy the ride ...

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, January 10, 2006

Rich businesses, poor businesses

I couldn't overhear a couple of men talking about Robert T. Kiyosaki's amazing book - Rich Dad, Poor Dad. The most important lesson, they said, was the generation of assets which give revenue. The word "asset" was suitably defined in terms of the revenue earned by the capital investment. They recited an interesting example of a house which, if kept vacant was a "liability" as you are losing an opportunity in utilizing the asset. Similarly, if given on rent - it is an "asset" owing to the fruitful use of capital.

Whats true for an individual must surely be true for an organization aswell. Let take an example - online share trading companies. Platforms like ICICI Direct, HDFC Securities, IndiaBulls etc. have today built up a technological backbone. These require minimal maintenance and yet there is no stopping the customers who want to use this facility. The fee (account opening and brokerage) can be quipped as rental income for these technology buildings.

The NOIDA Toll Bridge Co. Ltd. is a similar and very interesting example. It's almost a monopoly for travelling from Delhi to Noida and vice-versa. No one can do a thing about it. You can't fly from Noida to Delhi or perhaps take a boat from Delhi to Noida. Going around the toll bridge is rather expensive. Take situation 2 - what if NTBCL increase the toll fare from 30 rupees for a 4-wheeler to 40 rupees. Can anyone do anything about it?

In essence, these are true monopolies. In a previous blog, I had mentioned brand names which have a similar power. Paras Pharmaceutical has some of the most important brands in it's repetoire - Borosoft, D Cold, Dermicool, ItchGuard, Livon, Krack, Moov, RingGuard, Stopache etc.

That is one key difference in Rich and Poor businesses.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, January 9, 2006

A missed opportunity - Titan Industries

I first observed Titan Industries when it was around the 90 rupees per share mark. Seemed enticing, but the heavy debt in it's book stilled me away. The 90 in due course became 190 ... then 290... then 390 ... and 490 .... 590 (phew !!!) ... 690 (i was going crazy) ... 790 before it reached a high of 864 rupees per share.

Very few would have observed that the company had reached a P/E of 140. Crazy high for any company. This could have been a potent opportunity for short-selling the scrip. Something I strongly discussed with a colleague (Sonal). But then laxity-mania caught me and i didn't short the scrip. Day 1 after laxity-syndrome, Titan Industries drop by 6.6% and Day 2 it further dropped by 4.5%. Two days of killing lost !!!! (BSE Chart)

An over-heated market is like oil .. slick and slippery. Too much heat more often than not leads to a fire where even good stocks are not spared. Some other mid-cap stocks which are overheated - (stocks with P/E of 40 and above; market cap of over 500 crores)

a) Aztec Software & Technology Services Ltd.

b) Honeywell Automation India Ltd.

c) Trent Ltd.

d) iGate Global Solutions Ltd.

e) Atlas Copco (India) Ltd.

f) Ingersoll-Rand (India) Ltd.

g) J M Financial Ltd.

h) Astrazeneca Pharma India Ltd.

i) CRISIL Ltd.

j) New Delhi Television Ltd.

There are some big names here. Research strongly, there may be a strong case for short-selling and making crazy profits - EVEN IN HIGH MARKETS. (Remember, Mr Market)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, January 7, 2006

Numb3rs

I was watching the teleserial "Numb3ers" on AXN. It comes every Saturday between 7pm and 8pm. In today's episode a very interesting point emerged when a fellow detective (sniper) asked the mathematician if he had factored in the pulse of the gunner, the adrenalin rush he would have, the sweat on his forehead, the fact that he would measure the cover to avoid being sighted. The mathematician had made no such factorization - his theory was in anything, theoretical.

We can make a similar note in what Benjamin Graham told years before about Mr. Market (read from "Here's how Buffett describes it.... " in the link). Graham made evaluations on the scrip based on two numbers - his intrinsic price and the current price. In the process, he would also readily buy obscure companies which may be shams - just because the 'numbers added up'. This is where I feel Warren Buffett turned out to be one up on his master because he checked the adrenalin, sweat, pulse and factors of the scrip he was gunning after. Indeed a very important quality in stock investing which should not be left aside.

I have made a similar change in my stock pick research which has now moved from examining NCA to CMP to the use of debt-recapitalisations methods and price-earning ratios. A strong filter is put keeping atleast two of the three factors in mind. The second set of filter is on the management of the company and the industry per se. So we are now evolving our value investing practices.

Another very interesting observation in the episode was on "gaining expertise". In the episode, the mathematician illustrates by throwing a ball of paper in a waste basket bin. Shot 1 - he misses, Shot 2 - scores, Shot 3 - misses. Thats 1 out of 3 (33%). Then another three balls - 2 in and 1 out. Thats 3 out of 6 now (50%). Again 2 out of 3. Result - 5/9 (55%) and finally 3 out of 3 in which takes his tally to 8/12 (66%) success. There is a learning here ...

Often a greater jump is observed in stock prices of companies which do something new for the first time rather than for companies which have been doing it all the time. These jumps are associated with words (and not numbers :-)) like "restructuring", "alignment", "power brands" etc. More often, there is a chance of 1 out of 3 rather than 8 out of 12.

Think about it

Friday, January 6, 2006

Looking for hidden value

I was going through the annual report of "Kirloskar Brothers". All seemed fine when I arrived at the investments page of the company (Pg 36). The quoted investments in the balance sheet was 828,266,840 rupees. I peered through the schedules for further details. Under it's quited investments were a number of companies, one of them being "Kirloskar Oil Engines Ltd." - a rather well perfomring company. So Kirloskar brothers have 7,390,327 shares of this company which is listed in the books at 404,980,851 (i.e. 54.79 rupees per share). The current price of the same shares is 203.3 (7th Jan 2006). So the investments of Kirloskar Brothers Ltd. are atleast 1,502,453,479 rupees. (given their stake in Kirloskar Oil Engines). Add to this the remaining investments they hold.

There are numerous ways of finding value but the best to read the balance sheets of companies. Some companies have crazy amounts of land (SBI, CBI will qualify for this), some have investments (Sundaram Clayton in TVS Motors). Not just assets - I would look at patents in the same way, or an unstoppable franchise. Warren Buffett looked at Disney in the same way - "although Mickey Mouse and Snow-white may be written off in the Disney books, they are stil powerful franchise". Mattel Toy's Barbie would fall in the same league. Nearer to home, "CeaseFire" and "AquaGuard" have this distinction.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, January 5, 2006

Oil prices - where is it headed?

Increase in oil prices always has an inflationary effect on the economy. Worse still, this effect pans across the globe affecting each country which has energy requirements. Consulting firm, Delloites has some good views on the rising oil prices. The most striking part of the article posted in their website was on reasons why the world economies have been able to withstand the rise-in-oil-price blow. Here's their view-

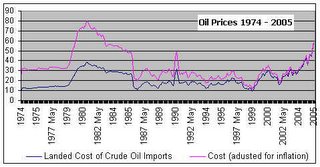

1. A number of economies are not dependent on energy driven sectors like manufacturing alone which is true fro countries like the US and India where services is the predominant sector over agriculture and manufacturing whose energy requirements are higher. 2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back

2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back

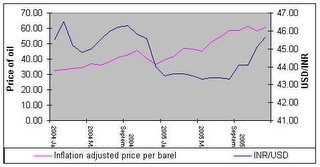

3. There has been a decline in the value of the dollar. This means, the price you pay for one barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -

barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -

Oct 2004 - Cost of purchase of 1 barrel = 2020.38 INR

Dec 2004 - Cost of purchase of 1 barrel = 1554.96 INR

4. There was also a time lag between people awakening to the fact that the rise in oil prices was not a temporary blip. It often happens across all industries and almost all situations.

5. Another striking part of the oil price rise, is that this one is demand-driven rather than it being supply driven. The larger consumers of oil are developing countries like India and China. With their economies growing at 7+%, these people will not raise a hue and cry over it.

All this may reverse if the following happen -

- China, India grow into energy guzzling monsters

- The USD for some reason appreciates vis-a-vis other currencies. (this will raise the import bill of oil for all countries)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |