It's been for a month now ... my dad has been harrowing me with "What's with your stocks ... do property ... it will pay you better". I kinda cant argue with him - given some amazing statistics he's been sharing with me over the last few weeks.

So here's the deal ... please email me some good (and very good) property investments in cities around India from an investment viewpoint (and short term 1.5-2 yrs). Feel free to let me know about residential, commercial, plots etc. But read the billboard again - investments only !!!

Kindly email the same at shankarnath@gmail.com

PS: I like that title ... what say you? Shall I change the blog title to "Liberty. Realty. Equity."

Saturday, February 25, 2006

Liberty. REALTY. Equity.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

NIIT Technologies

Increasing sales, increasing profits, good dividend yield and a P/E lower than industry peers ...

The business stats -

Share capital - 38.65 crs

Loans - 53.90 crs

Investments - 96.97 crs (in grp cos, so cant be factored in NCAV calc)

Net CA - 79.07 crs

FV - 10 rupees per share

Dividend - 5.50 rupees per share

LY profit - 40.25 crs

CMP - 175.00 rupees per share

This calculates to -

Dividend yield of 3.14%

P/E of 16.80

NCAV of 6.51 rupees/share (very low)

The sales and profit growth has been a neat 20% for this FY. I estimate a profit closing of 48 crs for this year and a dividend payout of 5.5 rupees per share (I would not accomodate an increase in dividend as the company is desirous of suitable acquisitions abroad which would be from internal accruals rather than any borrowings - pls note that the cost of funds has increased over the last 2 years in Indian and international markets; also an increase in debt in the balance sheet would affect the credit rating of the organisation and thereby increase the cost of funds).

Given the increase in profits for the year, the P/E moved go down to 14.09 which is much lower than most other software companies.

Infosys Technologies - 41.6

I-flex - 41.7

HCL Technologies - 81.3

Patni Computers - 32.9

Polaris Software - 19.5 (avoid this stock for now)

Satyam Computers - 34.0

TCS - 41.5

Wipro - 51.1

The management of the organisation is excellent and has a good vintage of 25 years. I like the fact that the education arm is present in around 40+ countries around the world including a huge presence in China. (A presence in China with 100+ education centres cannot be bad). This will help leverage the Software solution business in NIIT Technologies.

Disclaimer: My first job was with NIIT Ltd (not NIIT Technologies, I was in the education and training business - it was good fun working with the likes of Sanjeev Shrivastava, Gulraj Bhatia ... and excellent leaders in Mr. Rajender S Pawar and Mr. P Rajendran. This estimate is however devoid of any occupational loyalties. Do the math yourself for comfort.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, February 24, 2006

Rain Calcining and Gujarat NRE Coke

Yesterday, Sonal was rather excited about a tip he received in the morning. His anonymous tipper said "Buy Rain Calcining .. it's about to shoot up". The CMP of the stock was 40.2 in the morning, and before Sonal could check ... he eventually did that at 2:15 pm ... the price of the stock was 48.35 rupees.

In a serious bid to redeem ourselves from this folly, we set out to negate our dissapointment by trying to prove how wrong we would have had been, if we'd bought the stock. So here goes "our search for skewed analysis"

Share capital - 129.00 crs

Loans - 286.07 crs

Investments - 0.00 crs

Net CA - 107.71 crs

FV - 10 rupees per share

Dividend - 0 rupees per share

CMP - 40.2 rupees (morning price)

LY profit - 12.00 crs

At a P/E of 51.12 and an NCAV of negative 13.77 rupees/share, this was sure not practical. However the company has been posting some very good results.

Q1, 2005 : 13.60 crs

Q2, 2005 : 13.05 crs

Assuming similar trends, I estimate a maximum yearly profit of 42 crs because of (a) the tax charges (at a half-yrly income of 26.65 crs, the tax should be around 9 crs; the co. has surprisingly factored -2.51 and +2.71 crs for the two quarters) and (b) the interest charges (apportioned amount for half yr is only 10.91 crs while 10% of 286 crs would be close to 28.6 crs). At 42 crs of profit, P/E comes to 14.89 but the NCAV remains at (13.77). The company might just be in a position to give a dividend of 40 paise, which will not excite any market.

The company is outside my comfort zone. So, we didn't buy the stock. Today it fell to 43.80 rupees on the NSE.

Instead we checked out another company which works in the same industry - Coke/Metallurgical Coke production.

The business stats of Gujarat NRE Coke are -

Share Capital - 94.32 crs

Loans - 52.10 crs

Net CA - 77.15 crs

FV - 10 rupees per share

Dividend - 4.00 rupees per share

CMP - 86 rupees a share (Feb 23)

LY Profit - 90.78 crs

Like Rain Calcining, the profits for Gujarat NRE Coke have grown in Q1 and Q2 - 45.20 (32.76 in Q1, 2004) and 39.01 (27.83 in Q2, 2004). On this basis, I estimate a profit closing for this company at 120 crs for this year, which would mean a P/E of 6.76 (excellent). The NCAV of the stock is 3.36 (low).

Gujarat NRE Coke has one very good feature in it's unutilised debt capacity. On an interest coverage of 4, I estimate a total debt carrying capacity of 226.95 crs on LY numbers. Which means the m-cap of this stock (811.16) is around 358% of it's debt carrying capacity - fairly decent.

Oops.. and did I mention, at a profit of 120 crs - i would estimate a dividend payout of rupees 3.5 (outlay for the company would be 32.92 crs) ... which means a dividend yield of 4.07%.

Confession - I bought this stock yesterday at 89.8 rupees !!!

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, February 20, 2006

HCL Infosystems

HCL Infosystems plunged more than 30% today !!!!

The business stats of the stock are enclosed -

Share Capital - 33.44 crs

Loans - 81.31 crs

Investments - 122.77 crs

NCA - 340.60 crs

FV - 2.00 rupees per share

Dividend per share - 6.20 rupees

LY Profit - 132 crs

Thus, we have the following estimates -

1. I estimate the total profit for this FY for HCL Infosystems will be close to 105 crores. At a CMP of 180 rupees (close of day - Feb 20th 2006), that amounts to a P/E of 28.66 (profit may be more, but I'd rather be conservative)

2. Consequently, the dividend yield for this scrip will be at 3.44%

3. From a value perspective, NCAV for the stock is only 22.85 however, please note that this is an IT and ITES company which doesn't hold incredible amounts of NCAs .. barring maybe cash. The cash per share held by the company is however 8.67 rupees per share.

At 180 rupees, HCL Infosystems is rather enticing. The enclosed graph may stun you ... (see at the extreme right) ... for a stock which was comfortably between 240 and 260 for most part of the year.

Enclosed are two news stories you may like to read for a better understanding of the events that led up to this bloodbath -

[1] Nokia deal hits HCL Info as brokerages downgrade stock

[2] No reduction in revenues: HCL Infosystems

A very interesting case to analyse and make an investment decision.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Change is good

The recent change in conditions at HCL Infosystems is a good example of how any change in the 4Ps (price, place, product, public) can dent or raise a stock's going price.

To illustrate -

Say HCL Infosystems. Upon viewing the Q1 + Q2 data, I find that the change in agreement with Nokia, means the company has dented it's revenue numbers (ceteris paribus) by 40.12%. The new revenue number will be 3041 crores (i.e. 50% of 4074 crs from their telecom business plus 1004 crs from other businesses). The PBT would come to 115.5 crs - a dent of 32.06%. If I were to not question the fact that the HCL Infosystems stock is overly/fairly/under priced, the HCL Infosystems stock should have been at anywhere betwee 32% to 40% i.e. from a price of 259 rupees ... the fall should lie between 155 rupees and 176 rupees.

The stock had an intra-day low of 145 rupees and it closed at 180 rupees. Pricing anamoly.

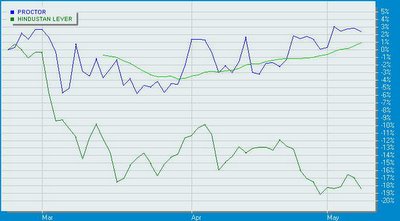

A more interesting example can be seen in the 2004 HLL-P&G price war where P&G initiated a price war by reducing the price of popular detergents by 25%. As a response, HLL followed suit with a 25% reduction in prices. The P&G scrips were at 405 on the day of the announcement and HLL stock was quoted at 174 rupees.

Surprisingly the P&G stock went upto 433 rupees by the first week of May (see charting) while the HLL stock actually reduced from it's levels by a good 18% till the first week of May (from 175 rupees to 142 rupees; HLL touched a low of 105 rupees on August 16th, 2004).

Same industry. Same reduction in price. Same effect to profitability. And yet, the 4th P (public) made a different inference.

But that's not the point .... Analyse this !!!! Detergents contributed only 24% to the total revenue of HLL. Which means the 25% reduction in price should have brought down the revenue by only (25% mult by 24%) ... 6%, but the market actually drilled down the HLL price by exactly the same amount of price cut i.e. TWENTY FIVE PERCENT.

A clear anomaly in understanding "impact on profitability".

Value investors kept on buying this stock as soon as it went below the price of 150 rupees. Easy money. Watch out for such opportunities !!!!

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, February 19, 2006

An excellent presentation on Value Investing by Prof. Sanjay Bakshi

Prof. Sanjay Bakshi is a visiting faculty at the Management Development Institute, Gurgaon. Enclosed is a presentation published by Capital Ideas Online where Prof. Bakshi extensively discusses the various techniques of value investing from an India perspective. He has featured a number of opportunities like Trent, Madura Coats, Zodiac Clothing etc. but none better than his acquisition of the GESCO Corp. The link is enclosed here.

Prof. Bakshi also maintains a most fabulous website in www.sanjbak.com.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, February 16, 2006

Amtek India - - is it another hidden goldmine?

Rakesh had posted a comment on a previous blog, seeking views on Amtek India. In a rather nonchalant manner I was examining the stock stats. Infact let me put down the stupid comments I was about to post ...

"Hi Rakesh, I checked out Amtek India. You may have something here. The stock is currently trading at a fwdP/E of 10.4 which is rather good. Though it doesn't have any margin of safety to speak of and a low dividend yield of 0.4% - I like the fact that it is growing at 25% year on year in Sales and Profits and fantastic management."

Repeat : it doesn't have any margin of safety to speak of

A look at the balance sheet may give a different picture. Annual Report. Pg 29 .. under Investments, reads 9675095 shares of Amtek Auto Ltd. of Rs. 2/- each .... amount 3511.2 lacs. So each share of Amtek Auto is being evaluated at rupees 36.29 only. The current price of the same Amtek Auto share (Feb 16th) is 302.00 rupees on the NSE. Which means, investments on the basis of this one holding itself is atleast INR 29,218.78 lacs (292.18 crores).

292.18 crores is exactly 50% of the current m-cap of Amtek India (587.86 crs).

There is my margin of safety.

Moral of the story ... always, always read the annual reports !!!!

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Overheated stock and the 20-day test

Three weeks back, I picked out a set of 24 stocks in order to arrive at certain patterns on overheated stocks (i.e. stocks to avoid now - which is as important as picking up the right ones). The list of 24 were on the basis of the biggest movers of the month and necessarily with an m-cap of 500 crs and above.

The following measures were estimated on the basis of the data available -

a) Profit for FY 2005-06 (on the basis of 3 quarters of results)

b) CMP of the stock on Jan 28th 2006 and as on 17th Feb 2006 (to calculate the fwdPE and movement in share price over the 20 day period)

The list is enclosed for your persual -

Some interesting patterns were observed.

1. Of the 10 stocks (out of 24) which had a P/E of over 40 - surpisingly only 5 stocks fell over the last 20 days, while 5 stocks actually gained thereby pushing up the fwdPE of the scrip. Shockingly, the ones that fell were within the 0-5% band while the ones that rose grew at ... 10.9%, 6.7%, 11.0% and a huge 29.1%.

2. Of the 10 stocks between a fwdPE of 20 to 40 - only two stocks went down, 6 of 'em went up while 2 remained at status quo.

3. Surprisingly, of the 4 stocks whose PE is well below the market P/E - THREE have actually performed worse at reduction in value of 13.2%, 10.1% and 11.0%.

It's as if, the market is punishing companies which are available at ridiculously low P/E and actually rewarding companies which exhibit a higher P/E.

Is this the elated Mr. Market at his very best?

We need some answers here ... fast !!!

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, February 15, 2006

Prasanth's comments and value picks

This blog is in response to Prasanth's comments. Prasanth found these stocks enlisted in the capitalideasonline round table. Enclosed is my evaluation of the same -

1. India Nippon Electricals

The evaluation in numbers –

NCAV (incl invts) – 97.14 rupees per share

Dividend – 8.50 rupees per share

FV – 10 rupees

There is nothing exciting about this stock, neither is there anything I feel rather uncomfortable about. The sales are rather constant, so are the profits. At a CMP of 276 rupees per share (Feb-14) and a fwdPE of 12.50, the stock is attractive enough. The dividend yield is also a decent 3.08%. It’s a fairly stable stock which has had rather minor swings over the last 12 months (the highest being a rise from 245 to 300 in 30 days). There is a fair chance of the stock going up in the next 5-6 weeks with moderate returns of 12-20%.

2. Cheviot Company Ltd.

A similar company to India Nippon Electricals, Cheviot has an NCAV (incl invt) of 225.98 on a CMP of 512.00 which is very decent. I approximate the fwdPE of this stock to be 6.42 and is currently at a dividend yield of 1.95%. The big spike in the Cheviot stock came in the month of August 2005 when it jumped up from 330 rupees to 600 rupees in 20 days; otherwise the going has been easy over the last 4 months. Very stable - sales and profits – not too exciting from a company standpoint, but a little under valued. I would not be able to comment on further movements in this stock, although there is a higher probability of the stock going up rather than down.

3. Investment and Precision Castings

A stock I held at one time (bought at 275, sold in a month at 525) and still retain one share (I tend to retain one share, because I get the annual report of the company then). Before dwelling on the financials, my advice is to not invest in stocks where the profit per quarter is very low. In this case, we are looking at close to 2 crores per quarter or 66 lakhs a month. This was one factor for me to move out of this stock. Surely one cant be comfortable with such a company. The business stats are enclosed –

a) NCAV – 126.61 rupees

b) CMP – 617.00 rupees

c) FwdP/E – 9.56

d) Dividend yield – 1.22%

4. Fem Care Pharma

Just the kind of stock you should never buy. A truly un-Graham stock with no “margin of safety”. Its more of a “Value shock” rather than a “Value Stock”. Examine these –

a) It has an NCA per share (incl invt) of 1.12 rupees per share against a CMP of 428 rupees

b) The company has never given a dividend in the last 5 years, except the last yr when it shelled out 5.1 rupees per share

c) The stock is at a fwdPE of 16.10 which is also very high

d) Sales and profits are growing at a miserly 15-20%

5. Motherson Sumi Systems Ltd

A good profitable company with expanding sales, Motherson Sumi is an evolved and fairly valued stock. The business stats of the same are enclosed –

NCAV – negative 1.67 / share

CMP – 82.00 rupees per share

FV – 1 rupee per share

Div. Yield – 1.22%

Profit (LY) – 62.09

P/E of 31.02 and fwd P/E of 27.92

An excellent company with a good management, the stock is largely overpriced given the specs above. Advise buy only if the stock goes down to around rupees 60.

In summary, Cheviot Company Ltd. seems to be the best buy of the 5 stocks listed. For it's stable revenues, stable profits, good NCA/CMP ratio, management and P/E ratio.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, February 14, 2006

Am I like this?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, February 12, 2006

Wisdom of value investors

There have been some great quotes associated with value investing and by value investors such as Graham, Buffett, Munger, Schloss etc. Enclosed is a compilation of the same -

"It's better to be approximately right than to be precisely wrong."

"What we learn from history, is that we don't learn from history."

"The more cash that builds up in the treasury, the greater the pressure to piss it away." (check ITC and it's foray in unrelated businesses)

"The smarter side to take in a bidding war is often the losing side." – Warren Buffett

"The most dangerous words in the investment business are, "this time it's different."" – John Templeton

"No matter how great the talent or effort, some things just take time: you can't produce a baby in one month by getting nine woman pregnant." – Warren Buffett

Courtesy: 1. Google.com; 2. 'My favourite quotes' by Sanjay Bakshi

My favourite is one which my first boss often recited - "With data you can prove anything ... even the truth". (one reason, why my posts look pathetic with no data)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, February 11, 2006

Are you looking at that "careers" page

Nope, im not looking for a job. Just something that my colleague Sonal pointed out - "always look for the 'Jobs available' column ... in the company website, or Ascent, or Business India etc." If a company is looking for a CEO or any top management personnel, then .... there are two possibilities -

a) The company profitability can take a hit if it is on shaky ground, or

b) There is a good probability that the price of the company stock may fall

This happens all the time, esp. when directors resign. There is often a vacuum and company performance goes bad. If the company is not a professionally managed one, then it will mean doom for a number of investor. An exact opposite of this notion is in an Accenture print ad .... link also attached !!!

Look out for these instances. Marginal changes in conditions often create strong value buy opportunities. The relevance of this point comes in when we link this to Warren Buffet's style of investment where he puts a higher focus on management. You might want to check the previous blog on "Teledatamatics" where Jagadish has commented on the "bad management" of the organization and on that basis (and some shoddy book-keeping) has recommended a NO BUY on the stock.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, February 10, 2006

Polaris

A Tale of Two Cities .... One city is called "Polaris HUMBLE-BE" and the other is known as "Polaris BUBBLE-BE".

Polaris Humble-be is a representation of the financial records of Polaris Software Labs i.e. the kind of thing. shareholders are concerned with - return on capital invested. Polaris Bubble-be is a news driven city where everything depends on the whims and fancies of inputs given by the news agencies. Here a glorious example in the making ....

Polaris Humble-Be:

1. Comparing the quarterly data of FY05 and FY06, I find -

a) Q1: Polaris PAT down 57% from FY05 numbers

b) Q2: Polaris PAT down 47% from FY05 numbers

c) Q3: Polaris PAT is negative. Losses of 7.54 crs (compared to 12.08 crs LY)

2. From a value perspective -

a) NCAV = 21.75 rupees per share

b) Debt free company

c) LY Dividend = 1.75 on a 5 rupees share. This year, I expect the company to give zero dividend because of the low profits.

d) Low cash reserves of 3.93 rupees per share

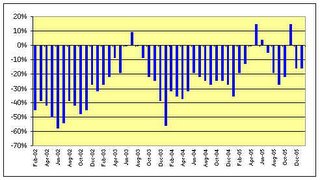

3. Share price charting at BSE ......

Here's a comparison of shares bought in various months and returns (excl dividend and assumed: if held till date) -

The graph clearly illustrates how the Polaris scrip has managed to give positive returns in only 4 months out of 48. (Hey.. i just remembered ... in my last job, this is how I used to sell hedge funds ... the investors used to get confused with so many graphs)

So Polaris was truly, a shareholder's nightmare.

Now, lets look at Polaris BUBBLE-BE :

Something is happening at Polaris and they are putting enough news in the air to make it count. Here are some news stories in review -

1. Polaris is ranked Best in the category for "specialty Application Development" (link)

2. Microsoft chooses Polaris as a Launch Partner in India for VS 2005 and SQL Server 2005 (link)

3. Polaris Software signs up Lloyds TSB for INTELLECT SUITE (link)

4. Polaris launches Collect.net (link)

This was major news till November 0f 2005. However one very interesting piece of news that hit the papers (The Hindu Business Line) on 10-Jan 2006 was when McKinsey submitted it's proposals to Polaris ... "stay focused on the legacy modernization services, where one sees big growth in the financial services space".

Lesson for us - At 109 rupees, Polaris Software Labs Ltd. is enticing. There are positive news in the vision/expansion/clients stream but the negative news are flowing in the financial areas. Graham would have been a NO-NO-NO for Polaris, but Warren Buffett might still tip in with a YES-YES-NO.

Whats your pick?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Hidden value in Sundaram Clayton

Sundaram Clayton Limited's balance sheet throws the following numbers -

Equity - 18.97 crs

Loans - 109.18 crs

Investments - 57.08 crs

NCA - 16.96 crs

PAT - 70.71 crs

FV - 10 rupees per share

Dividend - 9 rupees per share

CMP - 854 rupees per share (10-Feb)

A fairly expensive stock, whose valuation from our perspective would read -

1) NCAV of negative 48.61 rupees/share

2) Dividend yield of 1.05%

3) PE of 22.64; fwdPE of 17.79 rupees/share

However notice two items here -

[A] The market capitalization ... 854 rupees/share multiplied by 1.896 crores shares equals 1,619 crores

[B] The investments in the balance sheet reads 57.08 crores.

This is the most interesting. Apparently, SCL and it's subsidiaries have a significant portion of it's investments in the TVS Motor Company. To be precise, we are looking at - 135,000,000 shares of TVS Motors that SCL holds. (thats 56.83% of TVS Motors). Multiply these 135,000,000 shares with the current price of Rs. 120.45 per share (Feb 10) and you'll find that SCL holds investments worth a huge Rs. 16,260,750,000 from TVS Motors alone. i.e. 1,626 crores.

Which means, firstly the investments shown in the books of SCL of 57.08 crores are a pittance when we calculate the same, with the current market price and secondly, the value of the shares of TVS Motors that Sundaram Clayton holds is more than the market capitalization of Sundaram Clayton itself.

Surprisingly SCL values these investments at their face value (cost) rather than the market value. It's list of quoted investments include (other than TVS Motors) - 34,346 shares in ICICI Bank Ltd., 69,740 shares in HDFC Ltd., 500 shares in HDFC Bank Ltd. .. this itslef amounts to 115,833,904 (11.58 crores) as on Feb-10 '06. These shares have been valued by SCL at an amount of 1,045,000 rupees (10.45 lacs) ... i.e. at 0.902% it's actual value

But the fact that TVS Motors in SCL is greater than SCL itself is crazy !!! Yet true. This is like me paying a 'fairly evaluated' price for a cow, only to discover that it's pregnant with a couple of calves.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, February 9, 2006

Invest for value in good businesses

I've been receiveing a number of emails on the growing Indian equity valuations. At a PE of 18.6 and rising, "the Indian market is expensive" - most say. If I can infer better, they mean - "I am not able to find undervalued stocks". Additionally, there are two pertinent concerns here - is the stock I am picking overly valued and second, if the market tanks then will my stock crash also.

There are a number of theories that investors subscribe to, but if you are conservative one then start seeing every stock as "excellent businesses to own". So, all investments should be factored on ... I will buy stocks where -

a) Stocks which have a P/E of less than 15 (they will survive the crash better)

b) Stocks of companies which are either #1 or #2 in their industry

c) Stocks which have an earnings (PAT) of 50 crs + on an average over the last 5 years

Some extra level of comfort can be derived if -

1. Sales of the company is greater than the market capitalisation of the company

2. Look for rising sales and profits (atleast 30% over LY)

I shall now be featuring a number of stocks which are good businesses and subscribe to some of the parameters given here.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, February 8, 2006

PNB Gilts

Here's a "Wizard of Oz" opportunity.

Here are the business stats in the B/S of the company -

Equity - 135.01 crs

Loans - 790.6 crs

Investments - 5.37 crs

NCA - 1251.52 crs

LY dividend - 0.00 rupees

FV - 10 rupees per share

Profit for the year - negative 68.25 crs

This was last year. Now take a look at this year's numbers ....

Profit for Q1 - 16.53 crs

Profit for Q2 - 11.09 crs

Profit for Q3 - 12.12 crs

CMP - 22.35 rupees per share

Which means -

1. NCAV of PNBGIL is at 34.13 rupees (a true Grahamian stock !!!)

2. Estimated PAT for the year is 53 crs. So P/E at todays CMP should be 5.69.

3. Here's the clincher ... the cash inside the company is 16.69, so dont be surprised if the company awards a dividend of rupees 2 per share. That would blow your dividend yeild to 8.94%.

This is a classical case of an ignored stock. Since PNB Gilts is on the govt. securities and gilts market ... analysts have presumed that the proceedings will be shaky for this organisation.

Here's an news story on PNB Gilts : "... PNB Gilts, the primary dealer promoted by Punjab National Bank, is turning around after a difficult spell, thanks partially to its involvement in fee-based activities....". (and although news stories are something I show my backside to, this one is backed up with some solid data).

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, February 7, 2006

Lower the risk, higher the returns

In most scenarios, a greater risk is associated with a higher return and vice-versa. It's only in value investing that you'll find the very opposite picture. Let put this hypothesis to the test -

It's your first trip to New Delhi and you pick Karol Bagh (of all places) to shop. A stroll down Ajmal Khan Road and the crowd there, make you wonder why you would choose this of a thousand other places. On reaching the westend (where you have the Bata and Roshan-di-Kulfi shop), you come across a lane where two vendors are selling shirts. Equal in size, in colour, in quality and both are worth 100 rupees. So you know that you can sell the shirt to someone else at 100 rupees. Since it's off season, vendor A sells it at rupees 45 and vendor B sells the same shirts at rupees 60.

Which is more riskier - buying the shirt from A at 45 rupees or B at 60 rupees?

90% of all people I have asked this question have said "60 rupees". Think again. It's better to shell out 45 rupees for a 100 rupee shirt or 60 rupees for a 100 rupee shirt. A value investor (and most people) would be more comfortable paying 45 rupees than paying a higher sum of 60 rupees.

But where are the returns higher?

a) When you buy the shirt from A - Risk = 45 rupees; Return = 55 rupees

b) When you buy the shirt from B - Risk = 60 rupees; Return = 40 rupees

... which means lower the risk, higher the return (and vice-versa)

Howzzat !!!

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, February 5, 2006

The gods must really love crazy ...

My favourite scene in Rambo III (the one in which Rambo goes to Afghanistan to save a general) is where he participates in a horse race. The objective of the race is to pick up a dead sheep lying on the ground (while one is mounted on the horse) and carry it to the finishing line which is a good 200 metres from that point. Over 20 horsemen run around you, trying to snatch the sheep. In spite of a friendly guide's advice (where he says, that these people are all crazy) .. Rambo participates and wins the race. Then the rather aghast guide remarks - "God must really love crazy people, he makes so many of them."

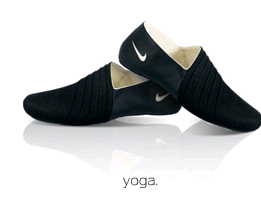

We have crazy companies aswell .... Nike .....They are known for sub-segmenting categories to sell more shoes like golf shoes, tennis shoes, basketball shoes etc. But now they have brought to market, an exclusive "yoga shoe" (these shoes have no heels). I am enclosing a picture.

The most amazing part of this entire initiative is "YOGA IS PRACTICED BARE FOOT". Crazy, isnt it?

The learning here is - It is these things that more often than not, jack up the stock price rather than true fundamentals. Also words like diversification, cost-cutting, acquisition, restructuring, demergering etc.

For a better insight on the same read the document - "THIRTY-NINE REASONS WHY AMATEUR INVESTORS FAIL TO BEAT THE MARKET OVER TIME". The fancy words point comes under point #26 (Failure to Understand True Growth). The document is an essential guide for every amateur investors in equities.

One of the most excellent quotes on this was once said by Peter Lynch :

“Wall Street seems to favour restructuring these days, and any director or CEO who mentions it is warmly applauded by shareholders. Restructuring is a company's way of ridding itself of certain unprofitable subsidiaries it should never have acquired in the first place. The earlier buying of these ill-fated subsidiaries, also warmly applauded, is called diversification.” – Peter Lynch, the highly successful fund manager and author of “One Up on Wall Street.”

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, February 2, 2006

How to read a company - Hindustan Constructions

This time round, I shall not be listing down the brief stats of the Hindustan Construction Company. For, when I sat down to read the company numbers on ICICIdirect .... a number of things caught my eye which often get missed when our world is around P/E ratios, m-cap, 52 wk H/L etc. You can view the ICICIdirect research section for all numbers on the company. Here's the link.

My observations -

a) The co. has a rather heavy loan amt in its books - 425.68 crs. The financial expenses incurred for servicing this debt was 54.19 crs. This becomes interesting when you observe that the company has been increasing it's debt input every year .. even more interesting when compared with the interest paid in servicing these debts under "financial expenses" in the P&L

statement.

2002 - Loan : 322 crs; Interest : 30.58 crs; Servicing : 9.50%

2003 - Loan : 379 crs; Interest : 50.90 crs; Servicing : 13.41%

2004 - Loan : 419 crs; Interest : 48.11 crs; Servicing : 11.47%

2005 - Loan : 425 crs; Interest : 54.19 crs; Servicing : 12.73%

Questions - Why does the loan rate increase in 2003, 2004 when the borrowing rates were it's lowest ever?

b) Look at the tax charges. You might find it unbelievable !!!

In March 2002, the company paid a tax charge of 48% on the profit before tax (PBT). In March 2005, the company paid just 9%. Two extremes.

c) Investments for FY2005 are placed at 189.92 crs. An analysis of the investments schedule in page 16 of the annual report reveals -

1. A significant portion of the investments (approx 51 crs) have been apportioned with Lavasa Corp. Ltd. - a 50% subsidiary of HCC.

2. Their exposure in MF is 130.74 crs and in a few equity shares of other companies. An interesting aspect was that a share like Hindustan Oil Exploration Ltd. (104400 shares) they hold is accounted at rupees 10 in their books while the CMP (31-Jan) in the market is 1342 rupees. The total (MF plus shares) is at 135.81 crores.

d) The company holds a cash balance of 3.81 rupees per share, so the dividend for the year can be as high as 90 paise. That will mean a dividend yield of 0.69%. This is low.

e) Q1, Q2 and Q3 for the company have been extremely good. Together they have closed at 81.3 crs. The big job is to predict the income numbers for Q4. Some points here -

1. As mentioned, financial charges for FY2005 was 54 crores. However in Q1, Q2 and Q3 of this year (all put together) only 32.8 crs have been accounted. So a huge chunk of 23-25 crores will be used in Q4.

2. Tax charges - Q1 plus Q2 plus Q3 equals only 10.7 crs. Even if I assume a tax charge of only 20% on PBT, I am looking at a tax of atleast 19 crs for Q4.

3. Extrapolating numbers (Q4 has been the best for HCC over the last two years), I would work out the PBIT to 58 crs. Cut an interest of 24 crs and a tax charge of 19 crs, my understanding of PAT should be 15 crs. Which would close the year for HCC at:

- PAT: 96.25 crs (a growth of 26% over LY)

- P/E: 35.51 (at todays CMP)

There is one important rule that Graham has always said (read: Intelligent Investor), "if you cant read the annual report of the company then you have no place in researching and investing in a stock. You are better off giving it to a mutual fund"

On reading the annual report (FY2005), I found the following statements you would be interested in -

1. This will confuse you ... on page 5, to the profit after tax, the management has added "Excess Tax Provision of earlier years written back" (and we here are discussing that the company is not paying enough taxes)

2. The total balance value of work on hand as on March 31, 2005 is Rs. 5381 crore including CompanyÂ’s share in the Integrated Joint Venture Projects.

The latest news item (Jan 24th 2006): "Hindustan Construction Company Ltd has informed that the Company has been awarded a contract for Rs 3,959 million from National Hydroelectric Power Corporation Ltd, Faridabad for Civil Works Package (Lot-I) (Construction of Diversion Arrangement, Concrete Gravity Dam Along with Spillway, Roller Compacted Concrete (RCC) Dam, Intake Structure, Surface Power House, Tail Race Channel, Switch Yard and Other Associated Civil Works) of Teesta Low Dam HE Project, Stage-IV (4x40 MW), West Bengal."

I took up this stock as a study of "how to read a company". However, the writing on the wall says : Is 149 rupees a good price to pay for this stock?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |