This article (here) was published in The Economic Times on 4th May 2008. (nah! I didnt write it).

"Manish Sonthalia of Motilal Oswal Securities believes that PSU banks like Oriental Bank of Commerce, which is trading at a PE of 5.6 with book value of Rs 240 for FY09, is a perfect example of a deep value stock." (unfortunately this was the only stock discussed in the entire article)

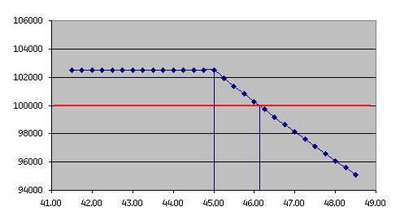

Recently, OBC declared it's Q4 results and showed a net loss of Rs. 99 crs as against a profit of Rs. 54 crs last year. Additionally, on a full year basis, OBC closed the year on a profit of Rs. 353 crs as against Rs. 580 crs last year. The primary reason for the lowering of profits was the writing-off of the entire unabsorbed losses of Global Trust Bank (GTB) amounting to Rs. 487 crore, including the Rs 242 crore earlier slated for 2008-09, in the financial statements for 2007-08 itself. This means OBC starts of FY08-09 on a clean slate.

To put some quick numbers around this - OBC will save on about Rs. 242 crores this year (apportioned as GTB write-off) this year. So reconstructing FY2007-08 numbers (without the OBC w/off) comes to -

Operating income : Rs. 5,800 crores

Other income : Rs. 615 crores

Operating expenses : Rs. 5,155 crores

Hence, profit before taxes : Rs. 1,260

Less: Taxes @ 35% : Rs. 441 crores

Net profit : Rs. 819 crores

At the current price of Rs.207 and a market cap of Rs 5,186 crores .. the stock is priced at a price-earning of 6.33. I am not assuming any increase in income here (or being a pessimist - am not apportioning additional provisions in the P&L for dubious asset quality). At 6.33, the stock is a bit undervalued. How deep the value is ... anyones guess !

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Friday, May 16, 2008

How to spot deep value stocks

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, May 14, 2008

Tough times are actually a good time for

Thomas Schoewe loves to say the phrase, "Tough times are actually a good time for Wal-Mart". This outlandish statement is infact coming. Consumers in the United States are riddled with rising food prices and huge cost of gas. This has made it difficult for most households to run their home and a number of them are living off credit. Consequently this year, Wal-Mart slashed grocery prices by as much as 30 percent to lure customers stung by high food costs. This brilliant strategy was promoted with enticing advertisements that read (and asked consumers) - "What will you do with your savings?"

In the last six months, Wal-Mart's stock price has risen $15 a share, or about 33 percent. During that time, Macy's shares dropped by 16 percent, Target's by 6 percent and JC Penney's by 5 percent. As their CFO says, "Wal-Mart customers value our price leadership more than ever, especially as they try to stretch their money even further".

Now, this is a brilliant "economic moat". A business that has the muscle to change potential problems into opportunities. Wal-Mart used it's efficiencies to actually display an advantage to it's customers .. this not only increases sales at stores but also builds loyalty. I am assuming that the stores donot make a loss on the sale of groceries, but are at a no profit-no loss situation. An average Wal-Mart customer doesnt earn his shopping dollars just on groceries. Groceries (i presume) are only 20% of all purchases (value) made by a customer at the stores. So, my 100 dollars at the shop will be split as 80 for other goods and 20 for groceries. I am further assuming that I would make a margin of 10% on groceries (on an average; since they are perishable, everyday commodities) and 15% on other goods. So spliting the spends on an 80:20 ratio, I find -

Case 1 : (80 * 15%) + (20 * 10%) = 14.0%

Case 2 : (80 * 15%) + (20 * 0%) = 12.0% (a small increase in sale is enough to off-set this reduction in profit margin which can be easily done by innovative pricing changes)

This also takes me back to my principles of micro-economics which reads - "In case of essential commodities like food, the demand curve is inelastic such that any increase in price will only induce just a small reduction in demand". This is true from an individual's point of view. However, from a firm's poin of view (Wal-Mart) ... this principle doesn't hold good. In this case, by virtue of lowering the price of food .. Wal-Mart has been able to post very high increase in traffic at their stores which has resulted in greater sales of other goods aswell. I'm wondering how soon will be see a similar campaign from an Indian retail firm (Subhiksha, Reliance, More, EasyDay, Food Bazaar) given the increasing food prices here.

On the subject of inelastic demand ... I'll leave you with a thought :

In March 2002, Ireland enacted a nationwide tax of nine pence (15 cents) on the use of plastic grocery bags, to be collected by retailers. Predictably, in just five months the tax cut plastic bag use by 90 percent.

What is the Price Elasticity of Demand for Plastic Grocery Bags?

PS: If you have an interest in economic policies then read more about this tax (here). Don't miss the comments section.

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, May 13, 2008

Cash is King !

The term "Cash is King" has a wikipedia entry. It reads, "Cash is king is an expression sometimes used in analyzing businesses; it refers to the importance of cash flow in the overall fiscal health of the business ... A company could have a large amount of accounts receivables on its balance sheet which would also increase equity, but the company could still be short on cash with which to make purchases, including paying wages to workers for labor. Unless it was able to convert its accounts receivable and other current assets to cash quickly, it could be technically bankrupt despite a positive net worth."

An interesting article appeared on the importance of cash on CNBC-TV18 (here), which claims that about 70% of companies reported a drop in net cash flows from operating activities. This is crucial because a strong operating cash flow pays for all capex requirements of the organisation and dividend to shareholders. If cash from operations declines for a company, then it might have to borrow from the market to finance it's growth plans. Given the current rate of interest, this is a double whammy - and needs to be factored into every stock evaluation.

Largest Build up in Cash Flows :

Biggest Drop in Cash Flows :

Note: I checked Pfizer (here). The net cash from operations is 17 crs and not 23 crs as stated in the article. There has been some extraordinary earnings for Pfizer which may change some variables in calculation of cash flow (i think, but not certain) .. so I'll not delve into it for now. To illustrate an example outside this list, Hero Honda's net cash from operations slipped from 936 crs in FY06 to 625 crs in FY07. In the same period, profits dropped mildly from 971 crs to 857 crs.

Net net, the importance of cash from operations cannot be ignored. This is the lifeline of most businesses and any decline in these numbers should be looked with the minutest precision before allocating your capital for these stocks.

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, May 12, 2008

Star-struck !

Look what I found !

Dharmesh Joshi from The Ganeshaspeaks Team had posted this on their blog (here). The title of the post read "Golden Period for Bank of Baroda from December 2008 to May 2009".

Here's what the post says -

"According to the Sun Horoscope of BOB's establishment date, Saturn and Ketu's presence in the wealth house might create some hindrances in its economic growth. However, as Mercury, Venus and Rahu are transiting through its Birth Chart, Jupiter will provide gains to the bank.

According to BOB,s nationalized date (19th July, 1969)'s Sun Horoscope, Saturn will transit through its Sun and Rahu will transit through its Birth Rahu taking a U turn between July 2006 and March 2007. However, after this period slow and steady growth is indicated for BOB.

The period starting from 10th December 2008 till 21st May 2009 can be considered as the golden period for BOB. It will create new history in the sector of banking.

May Lord Ganesha bless this bank with more and more depositors in the years to come!"

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, May 11, 2008

Allahabad Bank

Relatively Allahabad Bank is very cheap .. it's available at a PE of 4 and a dividend yield of 3.40%. Recently (May 2008), Emkay Research gave a buy call on Allahabad with a buy target of Rs. 170 per share. (here)

When I started to run the numbers on Allahabad Bank, the first thing I was interested in .. were the provisions numbers. Lately I went through a bank's quarterly report where the bank had drastically reduced the provisions for that quarter, and was hence able to show a higher net profit for the quarter. Given the increase in interest rates and rise in food prices of essential commodities, there is a higher probability of people defaulting on their loans than say, 12 months back. I'm glad to say that Allahabad Bank has infact, increased it's provisions for the quarter and year.

However this doesnt mean that all numbers deck up well. Some observations -

a) The net profit has declined sharply from last quarter. Q4 has delivered the lowest profits of all quarters, this year.

b) The Opex has risen sharply which will worry the bank. From just 281 crs (on a base of 1440 crs) - the expenses has risen to 508 crs (on a base of 1720 crs).

c) The administration of taxes seems a bit doubtful. The bank pays about 145 crs of taxes on a PBT of 1120 crs - which is about 12.9%. This seems a bit low .. but when I compare it with FY07 (7.6%), FY06 (4.7%) and FY05 (5.1%) .. this number seems pretty satisfactory.

The Emkay report rightly points out, "We like the continuance of the strategy of slower balance sheet growth as the advances have grown by 21% y-on-y compared to a 42% growth in FY07". I would still like to maintain a conservative picture around this because, in case of loans, the impact of intrepidness in lending is seen in about 12 months of the lending. (on a similar note, banks like Barclays and Reliance have gone crazy with lending activity. I received a call from Reliance Capital, about 3 months back where they were offering loans at 10%. The problem today faced by the banks & NBFCs is : while on a standalone your calculations will show that the loan applicant has sufficient income to take care of his expenses and pay off the loan ... the FIs just dont know the number of loans the person holds. If the applicant holds 2-3 loans, then no calculations will be useful as the chances of him/her defaulting is much higher than envisaged by our risk tools. I would blame the credit infrastructure in the country for this menace)

Since I am not good at evaluating banking stocks (the only stock I have ever bought or recommended in this space was Bank of Baroda), I compared Allahabad Bank's performance with Bank of Baroda (didnt include Kotak or ICICI Bank - they trade at very high PEs). Some notes -

a) The opex of BOB has historically been much higher than Allahabad Bank. But given Q4 results, both are pretty much equal.

b) The disappointing part of Allahabad's results were the NII which have been declining. This doesnt seem to be the case with BOB which still delivers rising NII.

c) Taxes paid by BOB are around the 35% mark (of PBT). Allahabad is still about 13% only, which is strange.

Note: the Dec quarter of BOB is nothing short of brilliant. The incomes have really risen but the lingering credit market fear has pushed the price of the stock down. You might want to look at Bank of Baroda aswell. Karvy had recommended a buy on BOB on 29th April 2008 (here)

It seems a number of banking stocks are undervalued. If we factor the 2009 RBI-opening-up-banking-regulations scenario, we can expect some M&A activity in banking which'll pick up the entire industry valuations too .. or I think it will.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, May 10, 2008

Notes from 2008 Wesco Shareholder Meeting

The complete notes are available at seekingalpha.com (here). I have picked a few interesting points delivered by Charlie Munger at the meeting. (My commentary in blue)

One of my favorite stories is boy in Texas, when the teacher asked the class the following question. There are nine sheep in pen, and one jumps out, how many are left? Everyone got it right, and said eight are left. The boy said none are left. The teacher said you don't understand arithmetic, and he said 'no you don't understand sheep'.

Charlie Munger here, refers to the domino effect where companies tend to imitate others (for quick gain) without an after-thought of the possible effects. This is especially true on account of the recent shakeout of financial companies across the world. In the US & UK, the sub-prime mortgage crisis (owing to mortgage-backed securities) have spelled down for Bear Sterns, Citigroup and Northern Rock (UK). In India, NBFCs like Citifinancial, GE Money (and banks like ICICI Bank) are facing peril at the hands of rising delinquencies in the small ticket segments.

If you are an investment bank and had to be rescued, there should be limits on leverage and the complications of your business. There should be qualitative limits too. By and large banks behaved well when it worked this way. When I was young, Bank of America – would not have done things they do now. Derivative trading, no good clearance, no rules, excess and craziness feeding on itself. The plain vanilla products got priced down to no profits. They wanted to do complicated stuff. Not sure if it cleared, or other side would be good for it. It didn't bother anyone since they wanted the profits .... People talk about marvels of system and risk transfer – but some of our troubles COME from having so much risk transfer.

Regulation has it's place in capitalism. To trust the market to correct by itself and letting ill-run companies die on their own is no longer an option (without jeopardizing the entire financial economy of the country). Munger also makes a point for simplicity and understanding of their actions. When financial corporations issued CDS, they assumed that the risk of default never existed. Firstly, their equity base was too small to bear this risk and secondly, unlike insurance, the risk of default on financial instruments is never random & can bankrupt companies in an instant. Munger also trackbacks to the art of value investing which is much more simpler than most of these alternate investments and often gives more value to the investor.

The only duty of corporate executives is to widen the moat. We must make it wider. Every day is to widen the moat. We gave you a competitive advantage, and you must leave us the moat. There are times when it is too tough. But duty should be to widen the moat. I can see instance after instance where that isn't what people do in business. One must keep their eye on ball of widening the moat, to be a steward of the competitive advantage that came to you. A General in England said, 'Get you the sons your fathers got, and God will save the Queen.'

Munger again captures the essence of value investing - "the art of finding an economic moat and widening it." From Berkshire's point of view, this is what their investments in Coca-Cola, Gillette, Disney, GEICO and NetJet have been - proof of which has been captured in the company's shareholder value.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

The choices we make

A senior member of my company narrated this joke today. Thought I'll share it with all.

"In Calcutta, my home town, there once lived a professor of mathematics. People appreciated his humility and also his vast experience in the field. He was a man of many skills and was also awarded with a medal from the chief minister.

Every year, somewhere around September, he would take a week off from college; go all the way to the hills of Darjeeling to a small cottage of his in the woods. In peace and surrounding tranquility, he would pray to lord Shiva for hours. A strict schedule of just 1 meal a day (comprising vegetable and soup), waking up at 5:00 in the morning and meditation for 8 hours - was enough to break anyone, but the professor. True to his faith, the professor spent 6 such days in the cabin.

On the 7th and final day, the lord appeared before the professor. The lord's smiling face was greeted by the professor's ecstatic amazement.

The lord said, "Thank you professor, for in these modern times too .. you have prayed for me. You are indeed a wonderful human being. And in return, I would like to grant you a wish. You can choose anyone of the following :

a) Wealth (you & your generations will never have to earn .. ever)

b) Beauty (you will have the most beautiful woman in the world as a wife)

c) Knowledge (you will be bestowed all the knowledge in the world)

The professor being a humble man, thanked the god and didn't want any of those wishes. But lord Shiva insisted. The professor had a choice to make. He said, "Hmm ... god, I am a professor and Saraswati is the most important thing to me ... I choose option c) - knowledge"

To which God said, "Granted". God was just about to leave for his heavenly abode, when suddenly the professor shouted, "Oh lord .. wait lord .. wait". The lord reappeared and asked, "What is the matter, professor?" ... and the professor meekly said, "I am sorry lord, can I have wealth please?"

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, May 8, 2008

Insurance agent plans airline

Truly inspiring article in Business Standard (here) !

Radhakrishna Shetty didn't let his humble beginnings come in the way of his dreams.

Radhakrishna Shetty, 44, is an agent of the state-owned Life Insurance Corporation as well as a financial advisor operating out of Mumbai, the financial capital of India. Don't expect this one to be lurching in corridors waiting to pounce on you with a new policy offer. Shetty is a millionaire agent, driving around in an expensive car, something many of his clients cannot afford.

More than that, Shetty has plans to start an airline. He has placed the order for a 180-seater Boeing aircraft and has asked a consultant to draw up a business plan for him. Meanwhile, his personal helicopter is on the way, making him, perhaps, the country's first life insurance agent to own one.

His plan is to start a budget airline that will fly on domestic routes. His hopes are pinned on an upcoming airport in Shimoga, 60 km from his hometown Chickmangalur. He is not too worried about the clutter in the low-cost aviation business and is confident of pulling it off.

For now, the project has been handed over to a consultant who will chart the routes and business model for him, which will be finalised only by March 2009. What he is sure about, however, is that he wants to fly and will stop at nothing.

Had someone met Shetty when he was a child, nobody would have believed that one day he would join the ranks of Vijay Mallya and Naresh Goyal.

Shetty's parents were labourers in a coffee plantation in his hometown. Despite the struggle to put enough food on the plate, his father would go to great lengths to educate his two sons, Shetty being the younger. He recollects growing up with just a bowl of Ragi porridge as the day's solitary meal. "It used to pain me that my family had to sacrifice food for our education," Shetty recollects.

He was on the verge of quitting studies, when he heard of the night school in Mumbai. Working through the day to support his family and studying in the nights appealed to young Shetty.

In Mumbai, he found himself a day job in a canteen at a fish market. His job entailed cleaning tables and vessels and also help in the kitchen, earning Rs 300 a month with the day's meals on the house and a small shack to sleep in. "My day would start at five in the morning with work in the canteen till 9 am.

From 9.30 am to 5 pm, I worked in a chartered account's firm. The rest of the day would be spent at college," he says. The day would end only after 11 pm, when he would finish cleaning the canteen.

"I hardly got four to five hours to study and to sleep. Those were very tough days for me," he says.

A chance meeting with a development officer in LIC changed his life for ever. The first four years as an LIC agent did not make any difference to his life. He managed to maintain his agency by meeting the minimum norms. In 1990, his income was less than Rs 10,000 a month — a decent sum but not enough to set up a sizeable business.

Things started changing after he met Logan Naidu, a motivational speaker in Bangalore in 1995. He learned about the trade association Million Dollar Round Table (MDRT) from Naidu, which became a source of inspiration. In the same year, he qualified for MDRT by earning Rs 2.88 lakh as commission. After that, there was no looking back for Shetty. His insurance commission alone for the year 2007-08 was around Rs 1.3 crore.

"Your need can be the best driving force for the customer as well as for yourself," he says. Shetty never wants to be financially comfortable so that he can keep running the race.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, May 7, 2008

Ansal Properties and Construction Limited

There was a mass exodus on this stock in the month of April by Indian mutual funds. From 3.96 million shares held by mutual funds in March 2008 ... the MF holding of the stock fell to a little over 72,000 shares in April 2008. And yet, when you look at the stock ... it is currently sitting pretty at a price-earning of 11.33. The NCAV of the stock is 78 rupees per share which is not bad at all (2.25 of CMP). While LY profits were 131 crs, this year's profits (FY08) are expected to close at 180 crs.

The stock price has been beaten down from a high of Rs. 500+ to about 176 rupees per share now. I found a couple of negative reports on the stock ...

a) In Feb 2008, Goldman Sachs in their report had removed Ansal Properties from the Conviction Buy list. The reasons sited was : "We have limited visibility on when option value on its Hi-Tech City project in Greater Noida is likely to be realised. The stock could remain on the sidelines until the market gets greater confidence on the group’s execution capability. We still rate the stock Buy and our revised 12-month potential RNAV based target price of Rs367 (from Rs410), implies 48% potential upside" (here)

b) This other one by ICICI Direct is even more interesting. I couldnt find too many details on the expected dip in profits (from 216 crs in FY07 to 50 crs in FY09) but I would assume that the lack of profits is due to some really long-term projects that the company has taken over such as the SEZ development in Punjab. (here)

I am a bit confused. At Rs. 174, the stock is very tempting and unless there is an event which I have missed out, the stock's a buy. Ansals' is a known name in the construction industry (although I have heard a number of stories in the press of the company bending rules in the past, I would like to believe that the outfit has improved in time by being more professional and transparent in dealings) and a PE of 11 is quite an anomaly.

However, I am still perplexed on why would mutual funds suddenly move away from a stock in herds. 4 million to 72,000 shares in MF ... there has to be an explanation !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, May 6, 2008

Investing in dreams

This article (here) in CNN Money Fortune is worth a read. Authored by Andy Serwer, the article comprises of excerpts to an interview with Larry Page on "how to change the world". Page talks extensively about breakthrough ideas that are round the corner but people fails to take a chance on them. Sighting his own example, he says, "Even when we started Google, we thought, "Oh, we might fail," and we almost didn't do it. The reason we started is that Stanford said, "You guys can come back and finish your Ph.D.s if you don't succeed."

Some thoughts Larry Page left behind in the interview :

1. Over 40,000 people a year are killed in the U.S. in auto accidents. Is there a chance of making this number zero or a very very small number. People are working on it - on making cars automated like the car by Infiniti which will kick you back when you change lanes (a large source of accidents). Using technology to save lives is not costly .. but there are very very few people working on it.

2. People think Moore's Law is a description of what happened. But Moore's Law actually caused people to do the right thing. Everyone was organized about it - making things better quickly.

3. Solar thermal is an area Google has been working on; the numbers there are just astounding. In Southern California or Nevada, on a day with an average amount of sun, you can generate 800 megawatts on one square mile. And 800 megawatts is actually a lot. A nuclear plant is about 2,000 megawatts.

4. Back in time .. everyone said Sam Walton was crazy to build big stores in small towns. But this turned out to be a breakthrough idea and Walmart is today the world's largest retailer. Almost everyone who has had an idea that's somewhat revolutionary or wildly successful was first told they're insane.

So who kills innovation? In the investment community, analysts are the first people who put the sword on any breakthrough innovation drive. The uncertain nature of the investment and the capital required to pursue the innovation activity deals a death knell for the stock price of the company. With most CEO compensation (and tenure in a company) linked to increase in shareholder value (read: price of share), it's evident that executives will work towards short term goals ranging from one quarter to the other .. to keep analysts happy and a uniform rise in price.

Investing in companies which can give a breakthrough idea is defined by high risks. Probably a value investor will not tread this path - as he cant see into the future as much as he can see a mismatch in the price and value of a stock. So a value investor might not invest in an Apple, Google, Starbucks, Zara, Pixar, IBM, Bionade, Iridium, P&G, Intel etc. because the PE ratio would never add up.

A couple of thoughts I leave here:

1. Is there a method of factoring innovation to our methodology of stock valuation?

2. How many Indian companies are there who have made such breakthrough ideas? (I can think of Infosys in outsourcing and Bharti Airtel is low cost telecommunication)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, May 5, 2008

Are Railroads a good investment in India?

Charlie Munger in the 2007 Wesco Annual Meeting spoke about investing in railroads. He delved into how they (Warren Buffett and Charlie Munger) shunned railroads till they identified the competitive advantage they presented. In his words -

Railroads – now that’s an example of changing our minds. Warren and I have hated railroads our entire life. They’re capital-intensive, heavily unionized, with some make-work rules, heavily regulated, and long competed with a comparative disadvantage vs. the trucking industry, which has a very efficient method of propulsion (diesel engines) and uses free public roads. Railroads have long been a terrible business and have been lousy for investors.

We did finally change our minds and invested. We threw out our paradigms, but did it too late. We should have done it two years ago, but we were too stupid to do it at the most ideal time. There’s a German saying: Man is too soon old and too late smart. We were too late smart. We finally realized that railroads now have a huge competitive advantage, with double stacked railcars, guided by computers, moving more and more production from China, etc. They have a big advantage over truckers in huge classes of business.

Bill Gates figured this out years before us – he invested in a Canadian railroad and made eight hundred percent. Maybe Gates should manage Berkshire’s money. [Laughter] This is a good example of how hard it is to change one’s mind and change entrenched thinking, but at last we did change.

The world changed and, way too slowly, we recognized this.

In addition to the competitive advantages stated by Munger, I would add one more to it : Cost of Fuel. At about $120 per barrel, we are way past the $20s of the 1990s or a bearable $50 in Jan 2007. Oil prices have risen 6 times over the last 10 years ! (here)

Trucks are a huge consumer of fuel (diesel) and with the finance minister indicating his inability to hold on to subsidies given for fuel .. it's obvious that industries will start looking at other sources of transportation. The next viable source is railways where coal, diesel or electricity is used as fuel. Sweeping changes are happening around the railways - multiple innovations in cargo carriers, a privatisation drive, rationalisation of charges etc. With increasing freight loads, the railways will soon become a serious challenger to roadways for movement to goods.

From an investors viewpoint, Container Corporation remains the market leader with 15 private entrants trying to churn a niche for themselves. Another related stock in the news is Titagarh Wagons. And then there was another company, Kalindee Rail.

Concor seems really interesting :

a) Increasing profits/sales every quarter

b) Dividend yield of 2.5% (probably increase this year)

c) Cash in company at 9% of m-cap

d) Zero debt

e) EV/EBIT of 10.8

f) Excellent FCF

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, May 4, 2008

Sterling Biotech

I am reading Sterling Biotech's financials on moneycontrol.com and wondering, why aren't mutual funds looking at this stock? More so, why aren't research houses tracking this stock?

Here's a company that -

a) Has just delivered Rs. 55 crs in net profits for the quarter ending 31st March 2008.

b) Sales has grown every quarter for the last 5 quarters

c) Both, sales and profits have grown at a 3-year CAGR of 32%

d) Operates at an OPM of 44%

e) Has a NPM of 20%

f) Has about 816 crores of cash/bank in it's books (which is 17.6% of m-cap)

The stock is currently at a 52-week high of around 205 rupees !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Value Trap

Over time, the most common measure of a stock's value or cheapness has been a low price-to-earnings ratio (P/E). But many investors who follow this trail often find themselves falling into the "value trap." To quote an old Japanese saying, "Yasukarou, warukarou—what is cheap may also be bad."

In an excellent article, (here) Amit Dugar explores the potential pitfalls of value investing and offers some practical guidance on avoiding the value trap.

An excerpt from the article :

The theory goes, with the cheaper share, investors are buying protection and lowering their risk. While investors expect a lot of future growth from a stock with a high double digit or triple-digit P/E, the market will often trash it at the slightest hint of trouble. On the other hand, the market is signaling it has low expectations for a stock trading at a single-digit P/E. Bad news is likely to have nowhere near the same impact on the low-P/E stock that it would have on the high-P/E one. The theory is that since the market has lower expectations, these stocks are more likely to show positive surprises in the future—with a greater likelihood of above-average returns.

In reality - some cheap stocks are dogs. That's where the value trap comes in. There are lots of examples of former high-flying growth stocks now selling for much lower P/E multiples than in the past. This does not necessarily mean that these stocks are now a good value. They may continue to fall, and may never recover. Without knowing their intrinsic values or possible catalysts for turnaround, you can't know whether they offer good value or not.

Notice the author talks of two important things here - 1. intrinsic value and 2. catalyst. I would like to talk a bit more about the catalyst.

A catalyst refers to an internal or external event (foreseeable or non-foreseeable) which dramatically moves the stock upwards or downwards. While we had explore a similar event like Siemen's one-time provision (post), the essence of a constructed catalyst (i.e. internal) is captured in the following items -

1. LBO (leverage buyouts) : When PE groups buy out publicly-traded companies and subsequently own them privately. The catalyst here is that speculation that certain publicly-traded companies might be ripe for picking by these private investors may increase the market price of their stock. An Indian example of LBO : KKR's acquisition of 85% in Flextronics (article in IHT)

2. Leveraged recapitalizations : are similar to LBO's in that such recapitalizations usually retire sizable amounts of the common stock of the publicly-traded companies involved, by buying it in the in the open market and replacing it with newly-issued debt. Unlike companies involved in LBO's, these companies' stock remains publicly-traded--but, again, speculation that XYZ Co. is going to do such a recapitalization will tend to increase the market price of its stock. My favourite case study on leveraged recap is the one on 'Sealed Air Case' (here)

3. Corporate split-ups : When companies divest part of their structure by giving such parts outright to the original companies' shareholders or selling the parts to other parties. Again, speculation of such deals will tend to drive up the stock price of those companies. There have been many split-ups in recent years with Reliance being the prominent example.

4. Huge stock buybacks : Many companies have been for years buying back their own publicly-traded shares on the open market. Of course, this buy-back activity tends to increase the market value of the stock by increasing the demand of the companies themselves for it. However, the investment community has grown a bit skeptic of buy-back announcement. Enclosed is a news article where UBS didnt term Dell's $10 bn buyback announcement as a catalyst (here)

5. Spin offs : The spin-off of a segment of the company that was not a good match with the rest of the company--is actually promoting future organic growth of the company. A recent Indian announcement was the proposed spin off of it's tower by Tata Teleservices (here).

These catalyst are instrumental in hiking or shunning the price of a share and value picks are no different. For any value stock to come out of a value trap, a catalyst is a must.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, May 3, 2008

JL Morison (India)

JL Morison (India) comes close to a Benjamin Graham pick. The specs of the company are enclosed -

Market cap : Rs. 38.54 crs

NCA : Rs. 81.22 crs

Debt : Rs. 40.16 crs

Share capital : Rs. 1.37 crs

FV : Rs. 10 per share

NCAV : Rs. 299.70 per share

At a CMP of Rs. 282 per share (May 3rd), the stock is available at a small discount to it's NCAV. It is interesting to note that the cash/bank in the company is Rs. 49.80 crores (much higher than the m-cap of the company or 63% of it's EV)

However on the earnings side, the net/operating profits are duh!. The business also holds about 11 crores of investments in it's balance sheet (I dont have the annual report with me to peek). If these investments are marketable securities then we can add that to the NCAV.

The stock seems partly Grahamian .. but we should avoid the value trap. I am following up this analysis with a post on value trap.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Shop and drop

An observation.

Stride Arcolab has acquired a 17% stake in Genepharm Australasia (here). The news article in Economic Times says that the shares were issued to Stride at A$0.55 (as against an original price of A$0.60).

How would you read into any situation where the seller reduced the price of a product? The 8% discount in acquisition price was on account of trading results and share performance, says the article. I peeked at the Genepharm Australasia stock chart on the Australian Stock Exchange (here). To my surprise, the stock has been going down from the day the company announced Stride Arcolab's 2.2% stake. The stock was priced at A$0.46 then. Currently, it is priced at A$0.22 (a drop of 52%). The EPS of the stock (trailing 4 qtrs) is A$0.15 .. which puts the stock at a PE of 1.5x.

I am surprised that Genepharm Australasia actually dipped so much inspite of a healthy news like this : Genepharm Australasia Ltd. reported earnings results for half year ended December 2007. For the period, the company reported net profit of AUD 1,343,000 or 0.9 cents per diluted share on net sales of AUD 32,174,000 compared to net loss of AUD 664,000 or 0.5 cents loss per diluted share on net sales of AUD 25,081,000 for the same period a year ago.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, May 2, 2008

How much is the Mona Lisa worth?

For a question like this (here), here are some answers that pop out -

a) It's priceless

b) It's worth $500 million

c) Prior to the 1962-63 tour, the painting was assessed for insurance purposes at $100 million. Adjusted for inflation since then -- $100 million in 1962 is approximately $645 million in 2005. So, thats the price of the painting today.

Incidentally there is one man who has "the" answer - Warren E. Buffett

In his letter dated January 18, 1964, Warren Buffett discusses "The Joys of Compounding" with the following insight :

Since the whole subject of compounding has such a crass ring to it, I will attempt to introduce a little class into this discussion by turning to the art world. Francis I of France paid 4,000 ecus in 1540 for Leonardo de Vinci's Mona Lisa. On the off chance that a few of you have not kept track of the fluctuations of the ecu, 4,000 converted out to about $20,000.

If Francis had kept his feet on the ground and he (and his trustees) had been able to find a 6% after-tax investment, the estate now would be worth something over $1,000,000,000,000,000 - That's $1 quadrillion or over 3,000 times the present national debt, all from 6%.

I trust this will end all discussion in our household about any purchase of paintings qualifying as an investment.

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Asian Electronics

My stock screener threw 'Asian Electronics' this week. Here's why -

a) From an asset perspective :

At an NCA (Mar-07) was Rs. 431 crores and total debt of Rs. 165 crores, Asian Electronic's NCAV is at 95.5 rupees per share. At a CMP of 196 rupees per share (May 1, 2008) ... the CMP/NCAV is 205% (I have started to move away from Grahamian's 66% rule .. it's too tough)

b) From an earnings perspective :

The business operates at an NPM of 25%. Barring the quarter of Dec '07, the business does over 100 crs of sales, yielding 25 crores of net profits on an average. Excluding the Dec quarter, the annual EPS is around Rs. 80. At a CMP of Rs. 196, we are looking at a normal PE of 2.45

Since the 400-500 levels the stock was in - about 4-5 months back - the stock has been beaten down to the sub-200 levels. This is owing to a disastrous Dec '07 quarter and general fall in the markets. This may be a special situation in the making ... if Asian Electronics can bounce back with it's usual 20 crores of profits for the next quarter then we have a story in our hands. (The research house, Prabhudas Lilladher, expects AEL to deliver 87 crs next quarter at a PAT of Rs. 13 crs (here)).

I have not invested in the stock yet .. wont mind a second opinion though.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, May 1, 2008

Power Grid Corporation of India

The Business Standard features an excellent article on Power Grid (here). The article talks about some businesses which Power Grid has, which can turn out to be hidden gems and a strong profit-centre 3-4 years from now. The report says -

1. The company owns and operates a fibre-optic cable network of 20,000 km, which connects over 100 Indian cities. This bandwidth is leased to more than 60 customers, including major telecom operators such as BSNL, Tata Teleservices, Reliance Communications and Bharti Airtel. The revenue from this segment has grown about ten-fold from Rs 7.4 crore in FY04 to Rs 77.3 crore in FY07 and stands at Rs 93.4 crore in the nine month ended FY08. These are estimated at about Rs 130 crore for FY08 and expected to grow at 25-30 per cent annually over the next few years. The net profit margin from this business is about 28-30%.

2. The company also plans to lease space on existing towers to mobile service providers. The company currently has about 200,000 transmission towers spread across the country. Even assuming that 15-20 per cent or 30,000-40,000 of these are available for leasing, the company is estimated to earn revenues in the range of Rs 600-700 crore annually by FY11 (considering prevailing tower rentals of Rs 35,000-40,000 per month). For FY09, leasing revenues are estimated at Rs 146 crore (7% of the total net profit) and at Rs 298 crore for FY10 (11.5% of the total net profit).

3. These apart, the company is also leveraging its vast experience in transmission related services, by providing consultancy services to various government funded projects such as implementation of projects under APDRP & RGGVY. Consultancy business, which is about 5.7 per cent of the total income, has grown from mere Rs 37 crore in FY04 to Rs 226.4 crore and is expected to grow fast on account of increasing allocation of funds for various projects.

The authors opine that Power Grid is available at a great valuation and it's buy time !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

What's a poof IPO?

A poof IPO is an unusual and innovative method of bringing groups of small companies in similar businesses, typically with tens of million dollars in revenues, to the public market. Using the funds from the initial public offering, the entrepreneurs are able to buy additional companies through a strategy known as a ''roll-up.''

Here's how it works : A venture capitalist will approach several private companies in the same industry, such as bus companies or air conditioning contractors. They then arrange an IPO to buy the companies and combine them into a single operating unit. The owners receive a combination of equity and cash. Some investors describe the maneuver as a ''poof IPO,'' a kind of magic act where several companies are transformed, poof, into one company.

Surprisingly, its a strategy that has attracted a lot of other players. Those who play the roll-up game, often known as consolidators, tend to seek fragmented markets with no clear market leader. The idea is to buy up lots of companies to boost revenues and earnings while saving money through economies of scale. Given the nature of the deal, it's evident that most such poof IPO deals happen when the stock market is at an unusual high.

It's a bit difficult to identify companies in the Indian context who can be identified as 'poof' IPOs. On 'roll ups', a company like Teledata Informatics seems close as it shows an insatiable appetite for lapping up companies in India, Singapore, UK, Thailand, Indonesia and US. (here).

However : the concept is innovative and can be very rewarding if operations can be perfectly consolidated, a strong management can be seated and a proper focus laid down for the business. Some areas, I can think of, that allow for such opportunities include medical centres (a chain of clinics), gymnasiums (a nation-wide branded health centre) etc. The reason why tuition centres might not fit the bill as they are uniquely service oriented & getting consistency in service and methodology might be difficult. So, the next time the stock market goes high and you can organise 10 similar business (of revenues of say, 1 crore each) ... do your math (10 businesses of 1 crore each at a multiple of 15 = Rs. 150 crore IPO) !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, April 29, 2008

Ports on the rise

A news item in the Business-Standard (here) referred to an Ernst & Young study, where the consulting firm are seeing an increased interest among investors in ports. The study found that ports are in favour as they provide a steady source of income. Ports, the study says, generate steady cash flows and operate on high margins.

Mundra Port has risen by 40% in the last 1 month. Running on a mammoth rupees 29,516 crores of market capitalisation, the Mundra Port management is quite upbeat about their projections for the company in the next few years. (here). I further read an ICICI Securities report (here) published when the scrip was priced at Rs. 580. The analyst awarded an upside of 44% (Rs. 835) from those levels. At a CMP of Rs. 736 today, there is still way for the stock to move.

Not too many ports in India are listed in the stock exchanges. However, I agree that ports will more important in the future as supplies move more frequently from port to port. This is quite the economic moat that Ben Graham often talks about. A port is a bit like the immigration desk at your airport ... without that stamp you cannot legally leave the country. With ports looking towards giving a unified, self-sustained ecosystem for industries and export units to flourish - their importance cannot be ruled out. My take on the sector is strong. However this doesnt mean that Mundra Port is a good buy (or a bad one). I just dont have an opinion as I have too little information to work on.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, April 28, 2008

Bharat Electronics

Cash and abundance are two words that dont go together for most companies. But not Bharat Electronics. Priced at Rs. 1207 (April 25th), the cash in the company (as on 31-Mar-07) was a heavy 260 rupees a share (2080 crores). This is about 21% of the m-cap.

Kotak and Indiabulls have given a BUY rating to the stock from it's current levels with a 25-30% upside. This is on account of -

a) Trading at 60% discount to BHEL in P/E terms (fwd PE estimates)

b) Expected rise in defence expenditure (rising at 15% p.a.)

c) Excellent free cash flows

BEL is an excellent business to be in. With a huge order book, it would be sometime before competitors can make a dent in BEL's market share and established markets. I was particularly impressed with the huge cash generator, the firm is. In one of the reports (i think it was Kotak), the research house expects the cash per share of BEL to close at Rs. 337 per share.

I have picked up some 10 shares today morning at 1234 rupees. The stock is upto 1296 rupees.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, April 27, 2008

Bond insurance

Weekend Reading : I read a couple of excellent articles on Berkshire Hathaway's participation as a bond insurer. An article in the NY Times (here) tracks how a phone conversation between Eric Dinallo and Berkshire's Ajit Jain paved the way for Berkshire to insure NY municipal bonds.

Ajit Jain, in a finely worded text (here), talks about how bond insurance helps bring stability to the price of bonds, offer protection to the investor in these bonds and keeps the interest rate low for bond issuers (as the bond is backed up by a AAA rated insurer).

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Its all even !

Chelsea beat Manchester United (2-1) at Stamford Bridge (26 April), to get equal on points (81 each) at the top of the English Premier League standings.

With just two matches to go for either sides, its all to play for from here. While United is better placed among the two teams (with a superior goal difference), their May 3rd match against 10th-placed West Ham will be crucial. The last time these two sides played .... West Ham defeated Manchester United (2-1; 29th Dec, 2007)

Everyone seems to be coming to the party including Jose "TSO" Mourinho. In an interview, the ex-Chelsea coach, in all his humility remarked : "It was me who taught Chelsea how to beat United" (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, April 26, 2008

R&D and Value investing

In value investing, technological innovations are a double-edged sword.

As businesses grow and improve spending on R&D, they find better ways of doing things. These product or process innovations are advantageous only if they improve their operating/net margin either though cost-savings or increasing the absolute profits (by a rise in volume). However the same innovation can be a bane if instead of keeping the cost-savings to themselves, businesses have to pass it over to the consumers. This is a double whammy - as the company spent tons of money for procuring the new technology and yet couldn't eat the fruits of their investment.

This doesn't mean that R&D is bad. As long as research leads to newer revenue lines or reduces costs and it's advantages needn't be passed on to the consumer (in other words, demand is price inelastic) - I'm all in favour of more investments in research. Lets take the PC industry. My father presented me a PC on my 7th birthday. It was an XT286 (from the 386, 486 line of computers). The PC was second hand and cost him a whopping 33,000 rupees (worth almost 90,000 rupees in today's money). Since then, technological innovations have put the XT286 on the extinction list. As the technology improved, the price of the PC didnt (it actually came down). For PC manufacturers like Dell, the margins dropped from 17% in the late 1990 to 4.5% in 2007 (lately, Dell has improved operating margins to 6.5%).

A value investor would look at these innovations carefully, to understand it's impact on the business (and his investment). So the next time, a company shouts at this new Plutonic-VBL-CV-Cyberquat101 technology that they have installed for cost-saving ... question them on whose pockets do the savings go to - the consumer or the shareholder?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Special Situations

Fidelity India runs a "Special Situations Fund". As it's fund update surmises the objectives of the fund (here), the areas identified as special situations include -

1. Turnarounds or recovery situations (underperforming companies with potential for recovery)

2. Underappreciated growth (companies whose growth characteristics have not yet been adequately recognized)

3. Asset plays (companies which sell at a significant discount to their underlying assets)

4. New product or new business streams (companies having a unique product with strong demand potential or opportunities to use existing resources for generating new business streams)

5. Corporate actions (companies which are potential candidates for mergers & acquisitions or where managements undertake significant restructuring of the business)

6. Out-of-favour stocks (unfashionable companies with improving fundamentals)

Incidentally, the Fidelity Fund celebrates it's 2nd birthday today ! Since inception, the fund that given an annualised return of 22.1% and in the last one year, performed at just 12.4%. Diversification doesnt seem to be a strength here as 6 of the top 8 holdings are in the BFSI segment currently. (here)

Siemens India ... a special situation

Siemens announced their Q2 results yesterday. The company's Q2 standalone net profit was at Rs 1.7 crore versus Rs 108.1 crore, YoY. (a drop of 99% !). Its standalone net sales were at Rs 2,142. crore versus Rs 2,129.2 crore, YoY. The reason for the drop in profits was a one-time provision for order reversals.

If the price of the stock gets beaten down on account of this one-time provision, then it might qualify for a special situation. While I am not aware of the amount of this one-time provision - given CNBC-TV18 estimates where the company was expected to post profit after tax of Rs 159.6 crore for this quarter - I shall assume the provision was a strong 157 crores.

The scrip is currently priced at Rs. 644 (April-25). The market is hinting a price drop of 40-50 rupees on account of this news. If that happens, then a perfect sound stock (assuming it is not already overpriced) would be trading 15% below it's fair price.

CNBC-TV18 further sees net sales going up at Rs 2,698 crore versus Rs 2,129 crore and OPM is likely to get improved at 8.4% from 7.6% for Q2. (the sales target was way off at Rs. 2,142 crores only; probably they maintained their previous OPM of 7.6%). In my calculations, a probable 15% drop in prices will not do the PE ratio a lot of good as it will still be over 30. However, the price drop might warrant a short-term gain.

Btw, an interesting presentation rounding Siemens' performance and businesses is available on their website (here)

April 29th : Siemens did fall by 10% and reached Rs. 580 per share. I bought the stock at Rs. 583.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, April 25, 2008

Visa Steel

PINC Research has given a 1-year target price for Visa Steel : Rs. 85.00.

Here's what the news article in the Economic Times says (here) : At the market price of Rs 48, the stock trades at a P/E of 2.8x and EV/EBITDA of 3x 2009-10 estimated earnings of Rs 16.90.

Given the fact that Visa Steel's 52-week high is Rs.65 ... a Rs. 85 target means the company is doing something outstanding which the markets (and hundreds of analysts) have not eyed thus far. Additionally, the research house is expecting a 75% appreciation in the stock from current levels.

I got curious :-) ... however, a cursory glance of the company's financials seems to offer a very different picture. An independent analysis is enclosed :

Equity capital : Rs. 110 crs

Face Value : Rs. 10 per share

LY profits : Rs. 20.5 crs

CY Profits : Rs. 22.5 crs (last 4 qtrs)

Debt : Rs. 498 crs

EV : Rs. 1041 crs

EBITDA : Rs. 64.68 crs (last 4 qtrs)

CMP : Rs. 49 per share

EPS : Rs. 2.04 per share

PE ratio : 23.9

EV/EBITDA : 16.06

The PE ratio and EV/EBITDA ratio for FY08 are 23.90 and 16.06 respectively. If PINC's earning estimate of Rs. 16.9 per share is correct, VISA Steel has to earn about 8.3 times of what it earned this year. This amounts to Rs. 186 crores of net profits for FY 2009-10.

Visa Steel operates at a net profit margin of 3.7%. Assuming this increases to as high as 5% (given some forwarding looking statements by the VISA Steel management), we are looking at sales of Rs. 3,720 crores for FY09-10 (which is 6.6 times of FY08 numbers). Now, this is the steel industry we're talking about ... sales increases need to be supported by capex increases ... which means more debt, more interest payments, more depreciation etc.

It would be interesting to read their report though. I have a thumbs-down on a Rs. 85 price target. From a value investor's view-point - there seems to be no margin of safety, power franchise or pricing anamoly that can be exploited.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Disruptive businesses

The Chicago Tribune featured a news item yesterday - "Microsoft tests subscription pricing for Office" (here). It's no secret that Microsoft is moving Office from a software to a service platform to ward off competition from other services like Google Docs, Zoho etc. Now, instead of paying USD 150 and upwards for an Office Home edition, people can subscribe to Office on a pay-as-you-go model.

I dont think Microsoft will be successful at penetrating the market with this paid subscription model, especially in a scenario where competitors like Google Docs are offering the product free-of-cost and allow an offline/online service. There is no differentiation here.

For a value investor, other than assets & price-earning, the business model & consequent advantages are very important. Warren Buffett found brilliant business models in GEICO and NetJets - bigger moats than PEs or NCAVs by his own revelation. As I question Microsoft's business model (and it's advantages) on launching a subscription based model ... the importance of pricing comes to the fore-front.

Pricing innovations have been in plenty in the Indian market -

- Reliance Communication's Rs.500-per-month mobile pricing plan

- Deccan's low cost venture caught Jet Airways and Indian Airlines off-guard

- Reliance Money flat fee broking accounts gave sweat beads to established players like ICICI Direct and Indiabulls

- ICICI Money2India remittance services played similar tricks with free money transfers from US (at the expense of Western Union)

Notice the common thread ... all four examples listed here are services (or products converted to services).

So if Xerox could lease their copier machines and charge a royalty .. why cant a similar thing happen in the consumer durable space? Why cant an LG start installing air-conditioners at residences on a pay-as-you-go model? Say, consumers pay Rs. 1,000 per month (for a Rs. 20,000 unit) and LG will take back the unit when the consumer doesn't want the "service" any longer. The consumer always has the option of keeping the entire unit for himself at a certain agreed price, which can further be financed.

Similarly, let me use the Reliance flat broking fees model on say, movie theatres. So the next time you go to a PVR, you dont need to buy a ticket. You can flash you Rs. 600 per month movie pass and walk in. Ofcourse, you will need to book a seat in advance using the PVR website. From a PVR point of view - they get fixed rental income for their theatre seats (now, not worrying about capacity or selling seats at a lower cost). For one, I dont understand why anyone can't enter a movie theatre without purchasing a ticket. Cant I just walk in for having a cuppa coffee there? (especially when everyone is watching a movie). Incidentally, this also means more revenue for theatres !

A case study : Netflix and Blockbuster

Alternate pricing models are not new, but what scares me is it's ability to disrupt industries (and more importantly, my stock value). Take the Netflix v/s Blockbuster case. In May 2002 Blockbuster was trading at USD 30.00, when Netflix (with a USD 76 mm revenue and a disruptive business model) brought out it's IPO. By Dec 2002, the Blockbuster stock was down to USD 13.00 and by Dec 2006, Blockbuster was trading at USD 5.00.

Currently the stock is priced at USD 2.88. This is irrespective of the fact that Blockbuster makes 4 times more revenue than Netflix and makes 400% more EBITDA. Inversely, Blockbuster's m-cap trails that of Netflix by over 40%.

Ironically, 5 or 10 years from now, it's quite possible that nobody will be renting DVD from a website (Netflix) or a store (Blockbuster). Today's cable companies seem to have a powerful distribution network via the on-demand model, and there is no reason to think that every movie that Blockbuster and Netflix have could be part of a mass digital library, accessible to every customer who has a cable box. That's the next phase of disruption !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Enterprise value and stock valuations

Every company has access to sources of funds - equity and debt. M-cap measures only equity and ignore the debt that a company absorbs. This is what happened in Videocon Appliances case. The uninformed investor's PE calculations is on the basis of an m-cap of just 95 crores and ignores 840 crores of debt. A value investor, on the other hand, would never ignore the debt number.

Increasingly, value is defined as the total funds needed to finance a company (rather than in terms of the PE ratio). This focuses less on returns in relation to accounting, and more on economic returns—in other words, the profits that a company is making on its supporting capital.

Lately, I have started to use a lot of EV analysis. Using enterprise value is often touted as a better approach to valuation, as opposed to just market capitalisation. EV calculations work on the premise that buying a stock is equal to buying a business i.e. the amount you would be paying buying the entire business. This includes the amount of debt the company has on books and subtracts the cash in the company. Thus, EV = M-cap + Debt - Cash

A case in point was Videocon Appliances. (here)

A cursory analysis of financial does make a good reading -

1. The stock is available at a PE of just 5.67. It's nearest competitors are priced much higher (Whirlpool at 20.6, BlueStar at 29.4).

2. The m-cap/sales is at just 7%

3. The company is profitable and is expect to earn about Rs. 17 crores of profits for the year. The operating profit is a huge Rs. 160 crores.

While the stock seems smartly placed for an investor .. EV tells a different story. The EV for Videocon Appliances is about 10 times it's market cap, on account of almost 840 crores of debt it carries on it's books. So as per the EV principle, if you were to purchase 100% of the business you would be paying 96 crs (m-cap) + 841 crs (debt) - 6 crs (cash) = Rs. 931 crores (EV).

The most used metric is EV/EBIT. At 931 crs of EV and an estimated EBIT of 77 crs ... the EV/EBIT comes to 12.10. Compare this with a Whirlpool .. which inspite of a P/E ratio of 20 ... comes at an EV/EBIT of 8.25.

In conclusion, as a buyer of a business ... you have 2 options :

1. Videocon Appl : available at 931 crs ; EBIT of 77 crs ; PE of 5.6 .... or,

2. Whirlpool India : available at 773 crs ; EBIT of 84 crs ; PE of 20

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Which one will you pick? (how useful is the PE ratio here?)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, April 24, 2008

Indian Premier League : A financial perspective

Alchemy released a report on the economics involved for teams participating in the IPL (here). I have heard a lot about franchisees overpaying for teams, players, rights ... and blaming BCCI for being non-transparent. Incidentally BCCI has itself called on franchisees to be patient and enjoy the fruits of their investment (read : ROI) after 3-4 years. Alchemy's report paints an optimist picture of the T20 cricket league and explains how much BCCI, the franchisees and supporting institutions (like Sony for media rights) tend to gain from the venture.

Surprisingly, the report claims that an individual franchisee will be profitable from year 1 onwards (page 7), scoring an EBIT of Rs. 4 crores. A bulk of the revenue (Rs. 90.2 crores) will come from global media rights (Rs. 25 crores), supported by ticket sales (15 crs), lead sponsor (15 crs) and in-stadia advertising (10 crs). From the cost angle, the franchisee cost takes the wind out of the financials with a Rs. 40 crs charge followed by player acquisition cost (Rs. 24 crs). The assumptions (on page 8) have not factored a number of things like cost of capital, or financing of the acquisition cost, or trading of players etc. These things happen a lot in soccer leagues around the world (Real Madrid finds it hard to survive until they have purchased the most expensive player in the world; am not sure where Jose Mourinho is headed but expect some big signings there too)

The report has drawn a number of parallels between the English Premier League (with two clubs - Tottenham Hotspurs and Arsenal) and the IPL. Not to mention, a number of these EPL teams are also listed on the stock exchange. Manchester United was listed in the London Stock Exchange (1992) at GBP 47 million. In 2005, American businessman Malcolm Glazer acquired a controlling interest in the club in a takeover valuing the club at approximately £800 million (approx. $1.5 billion) (here).

Perhaps, IPL is the alchemist's secret portion afterall !

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Eastern Silk

This stock pick has gone wrong for me ! (thankfully, it was not in my stock recommendations on this blog)

Eastern Silk today fell by 14.2% on the bourses. The reason : a Q4 loss of 15.63 crores (here). This follows 5 straight quarters of profits (18.40 crs, 15.46 crs, 19.02 crs, 21.18 crs, 25.52 crs).

What is scary is the drop in sales. From about 168 crores of sales last quarter, the sales have dropped to a mere Rs. 31.3 crores for this quarter.

I had bought Eastern Silk at 265 rupees a share. The current price is Rs. 179. The current PE is 3.48, BV is 211 rupees, EV/EBIT is just 2.8. (all three metrics are pretty encouraging)

What should be the next step ... does it make sense for me to wait .. or immediately sell off?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, April 23, 2008

Conflict of Interest & Credit Rating agencies

For people who use the services of financial advisors (also referred to as Private Banking Relationship Managers or Financial Consultants or Wealth Managers), it would seem odd that not one of them have actually advised the client to "hold on" to cash especially when there are not enough opportunities to invest in the markets or sure-shot stock picks. Often, the relationship managers find enough reasons to stash off this idle money in a single-premium insurance policy or a debt mutual fund or is an 'under-valued' sectoral mutual fund.

The only explanation I could come up for this is, conflict of interest. A relationship manager earns his fees (revenue for the bank) by getting clients invested in various financial products. He might view cash as a wasted opportunity for personal gain, although it might be in the client's best interest to show restraint in investing (esp. during tumulus times like these). Likewise, an RM will be eager to sell you an insurance policy as opposed to a mutual fund - as the former gives him a 30% commission as opposed to a meagre 2% commission for mutual fund investments.

Which makes me wonder - aren't research houses also in the same business? Isn't it in the interest of brokerage houses to inflate stock recommendations - so that investors put their money in the stock through their brokerage channel? At about 0.1% (average of delivery / intra-trade) for every rupee invested, a stock recommendation holds a lot of value. Motilal Oswal (here) has over 400,000 retail clients today and does broking revenue (FY2008) of 562 crores. Taking a ballpark of 0.1% revenue per rupee trade, they do about Rs. 562,000 crores of trades in a year (or Rs. 2,300 crores per day).

I would additionally suggest a reading of the latest Roger Lowenstein article on Moody's published in the NY Times (here).

The scribe starts off with an apt remark by Thomas Friedman in 1996 : "There were two superpowers in the world — the United States and Moody’s bond-rating service — and it was sometimes unclear which was more powerful.". (We now know who turned out the superior one !)

The article takes a hard look at how Moody's evaluated mortgages bundled as securities and assigned a rating to it. It also talks extensively of the mistakes they made in valuation of these securities and how the market crumbled due to lack of foresight, greed and trasparency (well, the lack of it). There is also a paragraph on conflict of interest - where rating industry's closeness with banks (whose securities they rate), often distorts their assessment of the instrument.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

SKF India

There seems to exist a buying opportunity with SKF Bearing. The largest player in India - the company is riding the expected increase in automobile sales in India and also the use of India as an outsourcing hub by other foreign car manufacturers. Additionally the company has now moved into other areas like marine, industrial, infra etc. (although %age contribution is very low at the moment). Annual Report (here)

The scrip is available at 309 rupees. The 52-week high for the scrip is 513 rupees and the 52-week low is 260 rupees. The brief financials of the company are enclosed -

Share capital : Rs. 52.73 crores

Face Value : Rs. 10 per share

Net Current Assets : Rs. 348 crores (Dec-07)

Debt : Nil

NCAV : Rs. 66 per share

CMP/NCAV : 4.68 (hence, non-Grahamian)

Book value : Rs. 103 per share

CMP/BV : 3.0 (not encouraging)

Enterprise Value : Rs. 1629 crores

EV/EBIT : 6.2 (encouraging)

1. Sales, operating profits and net profits have grown at 35%, 34% and 41% respectively. Given the size of the company, it will be difficult to sustain the same level of growth in sales. 2007 v/s 2006 sales growth was only 16% and I expect that to continue for FY2008. However, operating and net profits grew at 54% and 58% respectively. Again, 50 plus number might not be the deal this year. I have factored about 25% growth in op/net profits coming out of economies (new clients) but stained by high raw material price and slightly lower short-term demand.

2. Operating margins have improved over the last 3 years (13.4%, 11.4%, 15.1%). Over the last 3 quarters, the margins has improved to average 16%. NPM too has kept pace (6.9%, 6.8%, 9.2%).

3. From a price-earning view point, I was interested in mapping the historical PE ratio of the stock. I took the Dec 31st prices from all years from 2003 to 2007. The PE ratios have been quite sporadic (18.1, 15.1, 23.9, 13.6, 15.1). For one, the PE ratio in most years has been over 15.

To see if there was any near term opportunity, I further checked the PE ratio quarter-on-quarter. The results are enclosed :

Dec 06' > Price : 272, PE : 14.2

Mar 07' > Price : 319, PE : 15.0

Jun 07' > Price : 435, PE : 18.0

Sep 07' > Price : 388, PE : 14.1

Dec 07' > Price : 457, PE : 15.0

The current price (22 Apr) is Rs. 309 and hence, the PE ratio is 10.07. This represents an opportunity to invest in SKF India where the price-earning has predominantly been in the 15 range. In other words, there is a high probability that the price of SKF India will tend towards the 13-14 PE mark in the short term. This represents a potential price rise of almost a 100 rupees.

To confirm, I checked a Feb 2008 analyst report by Sushil Research (to be honest, I have not heard of this research house before). On the basis of the company's Q4 results (Oct-Dec 2007), the research house had claimed a BUY on the stock with a price target of Rs. 540 (Feb 22 CMP : Rs. 355). Another report published on 26 Nov, 2007 by Hem Securities gave a BUY call for SKF India with a target of Rs. 612 (the CMP on that date was Rs. 445).

PS: There was interesting news item in June 2007. It read "SKF India plunged 15.40% to Rs on 398 on announcement by parent SKF Group that it will make an investment of Rs 270 crore to build a greenfield factory in India for manufacturing large size bearings. The factory is expected to start production in 2008." ... since when did the Indian stock market consider capex commitments as bad news?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, April 22, 2008

Boiler Room

Boiler rooms operations are nothing but share scams. The stock operator will sell worthless shares at inflated prices to investors that are impossible to sell. (seems like a script from "Not a Penny More, Not a Penny Less", doesn't it?)

Here's how it works :

1. A broker, usually operating from an overseas firm, will cold call an investor and propose they buy shares in a particular company.

2. To avoid being ill prepared for the nosy web-savvy investor, the share would usually have been ramped on online message boards.

3. The company they are share dealing in will probably be - a) listed on an illiquid market or, b) could be a small, unquoted company that the broker claims is planning to list

4. So, one of two things will happen - a) the shares cannot be sold as there is hardly a market for it or, b) the company will not exist at all and the broker is simply selling shares in thin air before taking the money and running (extreme case)

The firms operate from boiler room 'hotspots', such as Spain, Switzerland, Dubai, Japan, Bermuda etc. They will always have a listed address and a grand sounding name to give an air of legitimacy.

These are called 'boiler room' scams because of the highly pressurised sales technique employed by the broker. They can be forceful, persistent and highly aggressive. A common tactic is to create a sense of urgency about a stock, such as telling the investor it will explode any day so they need to invest quickly.

Additional resource : The boiler room boys are back with a new 'bargain' (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Promoters hike stake as markets melt

An article featured in the Economic Times today (here) talks about how promoters have taken advantage of the market melt-down to hike their stakes in companies. ET estimates that around 100 promoters have increased their stake in Jan-Mar 2008. The prominent names include - Arvind Mills, Bombay Dyeing, Tata Metaliks, Reliance Energy, Aditya Birla Nuvo, Ultratech, JSW Steel, Max India, Bajaj Hindusthan and UB Engineering.

Promoters buying stock in companies they founded (or are major shareholders) often goes well with the stockmarket. A possible exception is Mr. Rao of Orchid Chemicals who has been frantically searching for monies and aides to lend him money to ward off a hostile bid by Solrex. Also, read an article featured on Business Today about 10 years back on why promoters should seek to increase stakes in companies. (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, April 20, 2008

To NRIs with love

I came across on a fabulous presentation "Revisiting FX as an Asset Class" (366 Kb) by Stephane Targui from the Corporate and Investment Banking division of BNP Paribas. Presented were a number of FX related structured product investments which I thoroughly enjoyed. One observation, which may be of good information to NRIs and foreign citizens is the limited use of plausible ‘risks’ in the pitch. These however were conveniently stashed away as part of the disclaimer.

Lets explore two such exotic options given under short-term structures -

[1] Dual Currency Option Deposit (DCOD) – I have always felt that the DCOD is the easiest product to sell to any investor who doesn’t take the pain of thinking just a step ahead. The presentation say the following about the product (slide 8 and 9) – “a deposit offering the certainty of a boosted rate, well above the money market”, “it is a win-win situation”

Let me explain the structure in an example –

1. Assume the two underlying currencies are the US Dollar (USD) and the Indian Rupee (INR). The spot rate (USD/INR) is 45.50

2. Your investment in the structure is 100,000 USD (so the USD is the deposit currency for you and you measure your wealth in dollars, and not rupees)

3. The structure reads like, if the USD/INR rate is greater than 45.00 then you shall get 10% p.a. for the 3 month period in INR for your deposit amount i.e. Rs. 46,12,500. However, if the USD/INR rate goes below 45.00 then you shall still get 10% p.a. for the 3 month period but in USD i.e. USD 102,500.

For anyone, this might seems a rather harmless transaction as you shall always get 10% p.a. for your efforts – whichever currency you end up with. But if I put the specs in a matrix, the results are rather annoying for any investor –

[a] Note that the structure is similar to selling a put wherein your gains are limited, while your losses (on conversion of the rupees, back to dollars) can be unlimited. Notice how my overall gains become (4896.61) USD if the USD jumps up to INR 48.50. This is one aspect that the presentation misses out on. So although the pitch revloves around how FX-related investments can boost your returns, ironically it's the same movement in FX that can fetch you a negative return aswell.

[b] These structures are callable at the option of the issuer e.g. BNP Paribas. So, they can, on any fine morning tell you to round off the numbers as they are closing the product. No surprises, why they may do so.

[c] Notice, no one will say if the principal is protected or not. As you have, now deduced that although this product WILL fetch you the 10% p.a. return HOWEVER WILL NOT guarantee you protection of capital invested. Interesting concept, ain’t it?