A news item in the Business-Standard (here) referred to an Ernst & Young study, where the consulting firm are seeing an increased interest among investors in ports. The study found that ports are in favour as they provide a steady source of income. Ports, the study says, generate steady cash flows and operate on high margins.

Mundra Port has risen by 40% in the last 1 month. Running on a mammoth rupees 29,516 crores of market capitalisation, the Mundra Port management is quite upbeat about their projections for the company in the next few years. (here). I further read an ICICI Securities report (here) published when the scrip was priced at Rs. 580. The analyst awarded an upside of 44% (Rs. 835) from those levels. At a CMP of Rs. 736 today, there is still way for the stock to move.

Not too many ports in India are listed in the stock exchanges. However, I agree that ports will more important in the future as supplies move more frequently from port to port. This is quite the economic moat that Ben Graham often talks about. A port is a bit like the immigration desk at your airport ... without that stamp you cannot legally leave the country. With ports looking towards giving a unified, self-sustained ecosystem for industries and export units to flourish - their importance cannot be ruled out. My take on the sector is strong. However this doesnt mean that Mundra Port is a good buy (or a bad one). I just dont have an opinion as I have too little information to work on.

Tuesday, April 29, 2008

Ports on the rise

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, April 28, 2008

Bharat Electronics

Cash and abundance are two words that dont go together for most companies. But not Bharat Electronics. Priced at Rs. 1207 (April 25th), the cash in the company (as on 31-Mar-07) was a heavy 260 rupees a share (2080 crores). This is about 21% of the m-cap.

Kotak and Indiabulls have given a BUY rating to the stock from it's current levels with a 25-30% upside. This is on account of -

a) Trading at 60% discount to BHEL in P/E terms (fwd PE estimates)

b) Expected rise in defence expenditure (rising at 15% p.a.)

c) Excellent free cash flows

BEL is an excellent business to be in. With a huge order book, it would be sometime before competitors can make a dent in BEL's market share and established markets. I was particularly impressed with the huge cash generator, the firm is. In one of the reports (i think it was Kotak), the research house expects the cash per share of BEL to close at Rs. 337 per share.

I have picked up some 10 shares today morning at 1234 rupees. The stock is upto 1296 rupees.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, April 27, 2008

Bond insurance

Weekend Reading : I read a couple of excellent articles on Berkshire Hathaway's participation as a bond insurer. An article in the NY Times (here) tracks how a phone conversation between Eric Dinallo and Berkshire's Ajit Jain paved the way for Berkshire to insure NY municipal bonds.

Ajit Jain, in a finely worded text (here), talks about how bond insurance helps bring stability to the price of bonds, offer protection to the investor in these bonds and keeps the interest rate low for bond issuers (as the bond is backed up by a AAA rated insurer).

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Its all even !

Chelsea beat Manchester United (2-1) at Stamford Bridge (26 April), to get equal on points (81 each) at the top of the English Premier League standings.

With just two matches to go for either sides, its all to play for from here. While United is better placed among the two teams (with a superior goal difference), their May 3rd match against 10th-placed West Ham will be crucial. The last time these two sides played .... West Ham defeated Manchester United (2-1; 29th Dec, 2007)

Everyone seems to be coming to the party including Jose "TSO" Mourinho. In an interview, the ex-Chelsea coach, in all his humility remarked : "It was me who taught Chelsea how to beat United" (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, April 26, 2008

R&D and Value investing

In value investing, technological innovations are a double-edged sword.

As businesses grow and improve spending on R&D, they find better ways of doing things. These product or process innovations are advantageous only if they improve their operating/net margin either though cost-savings or increasing the absolute profits (by a rise in volume). However the same innovation can be a bane if instead of keeping the cost-savings to themselves, businesses have to pass it over to the consumers. This is a double whammy - as the company spent tons of money for procuring the new technology and yet couldn't eat the fruits of their investment.

This doesn't mean that R&D is bad. As long as research leads to newer revenue lines or reduces costs and it's advantages needn't be passed on to the consumer (in other words, demand is price inelastic) - I'm all in favour of more investments in research. Lets take the PC industry. My father presented me a PC on my 7th birthday. It was an XT286 (from the 386, 486 line of computers). The PC was second hand and cost him a whopping 33,000 rupees (worth almost 90,000 rupees in today's money). Since then, technological innovations have put the XT286 on the extinction list. As the technology improved, the price of the PC didnt (it actually came down). For PC manufacturers like Dell, the margins dropped from 17% in the late 1990 to 4.5% in 2007 (lately, Dell has improved operating margins to 6.5%).

A value investor would look at these innovations carefully, to understand it's impact on the business (and his investment). So the next time, a company shouts at this new Plutonic-VBL-CV-Cyberquat101 technology that they have installed for cost-saving ... question them on whose pockets do the savings go to - the consumer or the shareholder?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Special Situations

Fidelity India runs a "Special Situations Fund". As it's fund update surmises the objectives of the fund (here), the areas identified as special situations include -

1. Turnarounds or recovery situations (underperforming companies with potential for recovery)

2. Underappreciated growth (companies whose growth characteristics have not yet been adequately recognized)

3. Asset plays (companies which sell at a significant discount to their underlying assets)

4. New product or new business streams (companies having a unique product with strong demand potential or opportunities to use existing resources for generating new business streams)

5. Corporate actions (companies which are potential candidates for mergers & acquisitions or where managements undertake significant restructuring of the business)

6. Out-of-favour stocks (unfashionable companies with improving fundamentals)

Incidentally, the Fidelity Fund celebrates it's 2nd birthday today ! Since inception, the fund that given an annualised return of 22.1% and in the last one year, performed at just 12.4%. Diversification doesnt seem to be a strength here as 6 of the top 8 holdings are in the BFSI segment currently. (here)

Siemens India ... a special situation

Siemens announced their Q2 results yesterday. The company's Q2 standalone net profit was at Rs 1.7 crore versus Rs 108.1 crore, YoY. (a drop of 99% !). Its standalone net sales were at Rs 2,142. crore versus Rs 2,129.2 crore, YoY. The reason for the drop in profits was a one-time provision for order reversals.

If the price of the stock gets beaten down on account of this one-time provision, then it might qualify for a special situation. While I am not aware of the amount of this one-time provision - given CNBC-TV18 estimates where the company was expected to post profit after tax of Rs 159.6 crore for this quarter - I shall assume the provision was a strong 157 crores.

The scrip is currently priced at Rs. 644 (April-25). The market is hinting a price drop of 40-50 rupees on account of this news. If that happens, then a perfect sound stock (assuming it is not already overpriced) would be trading 15% below it's fair price.

CNBC-TV18 further sees net sales going up at Rs 2,698 crore versus Rs 2,129 crore and OPM is likely to get improved at 8.4% from 7.6% for Q2. (the sales target was way off at Rs. 2,142 crores only; probably they maintained their previous OPM of 7.6%). In my calculations, a probable 15% drop in prices will not do the PE ratio a lot of good as it will still be over 30. However, the price drop might warrant a short-term gain.

Btw, an interesting presentation rounding Siemens' performance and businesses is available on their website (here)

April 29th : Siemens did fall by 10% and reached Rs. 580 per share. I bought the stock at Rs. 583.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, April 25, 2008

Visa Steel

PINC Research has given a 1-year target price for Visa Steel : Rs. 85.00.

Here's what the news article in the Economic Times says (here) : At the market price of Rs 48, the stock trades at a P/E of 2.8x and EV/EBITDA of 3x 2009-10 estimated earnings of Rs 16.90.

Given the fact that Visa Steel's 52-week high is Rs.65 ... a Rs. 85 target means the company is doing something outstanding which the markets (and hundreds of analysts) have not eyed thus far. Additionally, the research house is expecting a 75% appreciation in the stock from current levels.

I got curious :-) ... however, a cursory glance of the company's financials seems to offer a very different picture. An independent analysis is enclosed :

Equity capital : Rs. 110 crs

Face Value : Rs. 10 per share

LY profits : Rs. 20.5 crs

CY Profits : Rs. 22.5 crs (last 4 qtrs)

Debt : Rs. 498 crs

EV : Rs. 1041 crs

EBITDA : Rs. 64.68 crs (last 4 qtrs)

CMP : Rs. 49 per share

EPS : Rs. 2.04 per share

PE ratio : 23.9

EV/EBITDA : 16.06

The PE ratio and EV/EBITDA ratio for FY08 are 23.90 and 16.06 respectively. If PINC's earning estimate of Rs. 16.9 per share is correct, VISA Steel has to earn about 8.3 times of what it earned this year. This amounts to Rs. 186 crores of net profits for FY 2009-10.

Visa Steel operates at a net profit margin of 3.7%. Assuming this increases to as high as 5% (given some forwarding looking statements by the VISA Steel management), we are looking at sales of Rs. 3,720 crores for FY09-10 (which is 6.6 times of FY08 numbers). Now, this is the steel industry we're talking about ... sales increases need to be supported by capex increases ... which means more debt, more interest payments, more depreciation etc.

It would be interesting to read their report though. I have a thumbs-down on a Rs. 85 price target. From a value investor's view-point - there seems to be no margin of safety, power franchise or pricing anamoly that can be exploited.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Disruptive businesses

The Chicago Tribune featured a news item yesterday - "Microsoft tests subscription pricing for Office" (here). It's no secret that Microsoft is moving Office from a software to a service platform to ward off competition from other services like Google Docs, Zoho etc. Now, instead of paying USD 150 and upwards for an Office Home edition, people can subscribe to Office on a pay-as-you-go model.

I dont think Microsoft will be successful at penetrating the market with this paid subscription model, especially in a scenario where competitors like Google Docs are offering the product free-of-cost and allow an offline/online service. There is no differentiation here.

For a value investor, other than assets & price-earning, the business model & consequent advantages are very important. Warren Buffett found brilliant business models in GEICO and NetJets - bigger moats than PEs or NCAVs by his own revelation. As I question Microsoft's business model (and it's advantages) on launching a subscription based model ... the importance of pricing comes to the fore-front.

Pricing innovations have been in plenty in the Indian market -

- Reliance Communication's Rs.500-per-month mobile pricing plan

- Deccan's low cost venture caught Jet Airways and Indian Airlines off-guard

- Reliance Money flat fee broking accounts gave sweat beads to established players like ICICI Direct and Indiabulls

- ICICI Money2India remittance services played similar tricks with free money transfers from US (at the expense of Western Union)

Notice the common thread ... all four examples listed here are services (or products converted to services).

So if Xerox could lease their copier machines and charge a royalty .. why cant a similar thing happen in the consumer durable space? Why cant an LG start installing air-conditioners at residences on a pay-as-you-go model? Say, consumers pay Rs. 1,000 per month (for a Rs. 20,000 unit) and LG will take back the unit when the consumer doesn't want the "service" any longer. The consumer always has the option of keeping the entire unit for himself at a certain agreed price, which can further be financed.

Similarly, let me use the Reliance flat broking fees model on say, movie theatres. So the next time you go to a PVR, you dont need to buy a ticket. You can flash you Rs. 600 per month movie pass and walk in. Ofcourse, you will need to book a seat in advance using the PVR website. From a PVR point of view - they get fixed rental income for their theatre seats (now, not worrying about capacity or selling seats at a lower cost). For one, I dont understand why anyone can't enter a movie theatre without purchasing a ticket. Cant I just walk in for having a cuppa coffee there? (especially when everyone is watching a movie). Incidentally, this also means more revenue for theatres !

A case study : Netflix and Blockbuster

Alternate pricing models are not new, but what scares me is it's ability to disrupt industries (and more importantly, my stock value). Take the Netflix v/s Blockbuster case. In May 2002 Blockbuster was trading at USD 30.00, when Netflix (with a USD 76 mm revenue and a disruptive business model) brought out it's IPO. By Dec 2002, the Blockbuster stock was down to USD 13.00 and by Dec 2006, Blockbuster was trading at USD 5.00.

Currently the stock is priced at USD 2.88. This is irrespective of the fact that Blockbuster makes 4 times more revenue than Netflix and makes 400% more EBITDA. Inversely, Blockbuster's m-cap trails that of Netflix by over 40%.

Ironically, 5 or 10 years from now, it's quite possible that nobody will be renting DVD from a website (Netflix) or a store (Blockbuster). Today's cable companies seem to have a powerful distribution network via the on-demand model, and there is no reason to think that every movie that Blockbuster and Netflix have could be part of a mass digital library, accessible to every customer who has a cable box. That's the next phase of disruption !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Enterprise value and stock valuations

Every company has access to sources of funds - equity and debt. M-cap measures only equity and ignore the debt that a company absorbs. This is what happened in Videocon Appliances case. The uninformed investor's PE calculations is on the basis of an m-cap of just 95 crores and ignores 840 crores of debt. A value investor, on the other hand, would never ignore the debt number.

Increasingly, value is defined as the total funds needed to finance a company (rather than in terms of the PE ratio). This focuses less on returns in relation to accounting, and more on economic returns—in other words, the profits that a company is making on its supporting capital.

Lately, I have started to use a lot of EV analysis. Using enterprise value is often touted as a better approach to valuation, as opposed to just market capitalisation. EV calculations work on the premise that buying a stock is equal to buying a business i.e. the amount you would be paying buying the entire business. This includes the amount of debt the company has on books and subtracts the cash in the company. Thus, EV = M-cap + Debt - Cash

A case in point was Videocon Appliances. (here)

A cursory analysis of financial does make a good reading -

1. The stock is available at a PE of just 5.67. It's nearest competitors are priced much higher (Whirlpool at 20.6, BlueStar at 29.4).

2. The m-cap/sales is at just 7%

3. The company is profitable and is expect to earn about Rs. 17 crores of profits for the year. The operating profit is a huge Rs. 160 crores.

While the stock seems smartly placed for an investor .. EV tells a different story. The EV for Videocon Appliances is about 10 times it's market cap, on account of almost 840 crores of debt it carries on it's books. So as per the EV principle, if you were to purchase 100% of the business you would be paying 96 crs (m-cap) + 841 crs (debt) - 6 crs (cash) = Rs. 931 crores (EV).

The most used metric is EV/EBIT. At 931 crs of EV and an estimated EBIT of 77 crs ... the EV/EBIT comes to 12.10. Compare this with a Whirlpool .. which inspite of a P/E ratio of 20 ... comes at an EV/EBIT of 8.25.

In conclusion, as a buyer of a business ... you have 2 options :

1. Videocon Appl : available at 931 crs ; EBIT of 77 crs ; PE of 5.6 .... or,

2. Whirlpool India : available at 773 crs ; EBIT of 84 crs ; PE of 20

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Which one will you pick? (how useful is the PE ratio here?)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, April 24, 2008

Indian Premier League : A financial perspective

Alchemy released a report on the economics involved for teams participating in the IPL (here). I have heard a lot about franchisees overpaying for teams, players, rights ... and blaming BCCI for being non-transparent. Incidentally BCCI has itself called on franchisees to be patient and enjoy the fruits of their investment (read : ROI) after 3-4 years. Alchemy's report paints an optimist picture of the T20 cricket league and explains how much BCCI, the franchisees and supporting institutions (like Sony for media rights) tend to gain from the venture.

Surprisingly, the report claims that an individual franchisee will be profitable from year 1 onwards (page 7), scoring an EBIT of Rs. 4 crores. A bulk of the revenue (Rs. 90.2 crores) will come from global media rights (Rs. 25 crores), supported by ticket sales (15 crs), lead sponsor (15 crs) and in-stadia advertising (10 crs). From the cost angle, the franchisee cost takes the wind out of the financials with a Rs. 40 crs charge followed by player acquisition cost (Rs. 24 crs). The assumptions (on page 8) have not factored a number of things like cost of capital, or financing of the acquisition cost, or trading of players etc. These things happen a lot in soccer leagues around the world (Real Madrid finds it hard to survive until they have purchased the most expensive player in the world; am not sure where Jose Mourinho is headed but expect some big signings there too)

The report has drawn a number of parallels between the English Premier League (with two clubs - Tottenham Hotspurs and Arsenal) and the IPL. Not to mention, a number of these EPL teams are also listed on the stock exchange. Manchester United was listed in the London Stock Exchange (1992) at GBP 47 million. In 2005, American businessman Malcolm Glazer acquired a controlling interest in the club in a takeover valuing the club at approximately £800 million (approx. $1.5 billion) (here).

Perhaps, IPL is the alchemist's secret portion afterall !

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Eastern Silk

This stock pick has gone wrong for me ! (thankfully, it was not in my stock recommendations on this blog)

Eastern Silk today fell by 14.2% on the bourses. The reason : a Q4 loss of 15.63 crores (here). This follows 5 straight quarters of profits (18.40 crs, 15.46 crs, 19.02 crs, 21.18 crs, 25.52 crs).

What is scary is the drop in sales. From about 168 crores of sales last quarter, the sales have dropped to a mere Rs. 31.3 crores for this quarter.

I had bought Eastern Silk at 265 rupees a share. The current price is Rs. 179. The current PE is 3.48, BV is 211 rupees, EV/EBIT is just 2.8. (all three metrics are pretty encouraging)

What should be the next step ... does it make sense for me to wait .. or immediately sell off?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, April 23, 2008

Conflict of Interest & Credit Rating agencies

For people who use the services of financial advisors (also referred to as Private Banking Relationship Managers or Financial Consultants or Wealth Managers), it would seem odd that not one of them have actually advised the client to "hold on" to cash especially when there are not enough opportunities to invest in the markets or sure-shot stock picks. Often, the relationship managers find enough reasons to stash off this idle money in a single-premium insurance policy or a debt mutual fund or is an 'under-valued' sectoral mutual fund.

The only explanation I could come up for this is, conflict of interest. A relationship manager earns his fees (revenue for the bank) by getting clients invested in various financial products. He might view cash as a wasted opportunity for personal gain, although it might be in the client's best interest to show restraint in investing (esp. during tumulus times like these). Likewise, an RM will be eager to sell you an insurance policy as opposed to a mutual fund - as the former gives him a 30% commission as opposed to a meagre 2% commission for mutual fund investments.

Which makes me wonder - aren't research houses also in the same business? Isn't it in the interest of brokerage houses to inflate stock recommendations - so that investors put their money in the stock through their brokerage channel? At about 0.1% (average of delivery / intra-trade) for every rupee invested, a stock recommendation holds a lot of value. Motilal Oswal (here) has over 400,000 retail clients today and does broking revenue (FY2008) of 562 crores. Taking a ballpark of 0.1% revenue per rupee trade, they do about Rs. 562,000 crores of trades in a year (or Rs. 2,300 crores per day).

I would additionally suggest a reading of the latest Roger Lowenstein article on Moody's published in the NY Times (here).

The scribe starts off with an apt remark by Thomas Friedman in 1996 : "There were two superpowers in the world — the United States and Moody’s bond-rating service — and it was sometimes unclear which was more powerful.". (We now know who turned out the superior one !)

The article takes a hard look at how Moody's evaluated mortgages bundled as securities and assigned a rating to it. It also talks extensively of the mistakes they made in valuation of these securities and how the market crumbled due to lack of foresight, greed and trasparency (well, the lack of it). There is also a paragraph on conflict of interest - where rating industry's closeness with banks (whose securities they rate), often distorts their assessment of the instrument.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

SKF India

There seems to exist a buying opportunity with SKF Bearing. The largest player in India - the company is riding the expected increase in automobile sales in India and also the use of India as an outsourcing hub by other foreign car manufacturers. Additionally the company has now moved into other areas like marine, industrial, infra etc. (although %age contribution is very low at the moment). Annual Report (here)

The scrip is available at 309 rupees. The 52-week high for the scrip is 513 rupees and the 52-week low is 260 rupees. The brief financials of the company are enclosed -

Share capital : Rs. 52.73 crores

Face Value : Rs. 10 per share

Net Current Assets : Rs. 348 crores (Dec-07)

Debt : Nil

NCAV : Rs. 66 per share

CMP/NCAV : 4.68 (hence, non-Grahamian)

Book value : Rs. 103 per share

CMP/BV : 3.0 (not encouraging)

Enterprise Value : Rs. 1629 crores

EV/EBIT : 6.2 (encouraging)

1. Sales, operating profits and net profits have grown at 35%, 34% and 41% respectively. Given the size of the company, it will be difficult to sustain the same level of growth in sales. 2007 v/s 2006 sales growth was only 16% and I expect that to continue for FY2008. However, operating and net profits grew at 54% and 58% respectively. Again, 50 plus number might not be the deal this year. I have factored about 25% growth in op/net profits coming out of economies (new clients) but stained by high raw material price and slightly lower short-term demand.

2. Operating margins have improved over the last 3 years (13.4%, 11.4%, 15.1%). Over the last 3 quarters, the margins has improved to average 16%. NPM too has kept pace (6.9%, 6.8%, 9.2%).

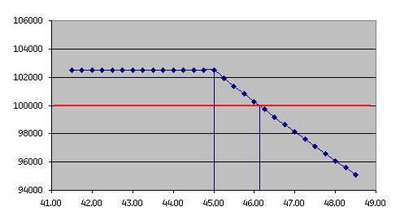

3. From a price-earning view point, I was interested in mapping the historical PE ratio of the stock. I took the Dec 31st prices from all years from 2003 to 2007. The PE ratios have been quite sporadic (18.1, 15.1, 23.9, 13.6, 15.1). For one, the PE ratio in most years has been over 15.

To see if there was any near term opportunity, I further checked the PE ratio quarter-on-quarter. The results are enclosed :

Dec 06' > Price : 272, PE : 14.2

Mar 07' > Price : 319, PE : 15.0

Jun 07' > Price : 435, PE : 18.0

Sep 07' > Price : 388, PE : 14.1

Dec 07' > Price : 457, PE : 15.0

The current price (22 Apr) is Rs. 309 and hence, the PE ratio is 10.07. This represents an opportunity to invest in SKF India where the price-earning has predominantly been in the 15 range. In other words, there is a high probability that the price of SKF India will tend towards the 13-14 PE mark in the short term. This represents a potential price rise of almost a 100 rupees.

To confirm, I checked a Feb 2008 analyst report by Sushil Research (to be honest, I have not heard of this research house before). On the basis of the company's Q4 results (Oct-Dec 2007), the research house had claimed a BUY on the stock with a price target of Rs. 540 (Feb 22 CMP : Rs. 355). Another report published on 26 Nov, 2007 by Hem Securities gave a BUY call for SKF India with a target of Rs. 612 (the CMP on that date was Rs. 445).

PS: There was interesting news item in June 2007. It read "SKF India plunged 15.40% to Rs on 398 on announcement by parent SKF Group that it will make an investment of Rs 270 crore to build a greenfield factory in India for manufacturing large size bearings. The factory is expected to start production in 2008." ... since when did the Indian stock market consider capex commitments as bad news?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, April 22, 2008

Boiler Room

Boiler rooms operations are nothing but share scams. The stock operator will sell worthless shares at inflated prices to investors that are impossible to sell. (seems like a script from "Not a Penny More, Not a Penny Less", doesn't it?)

Here's how it works :

1. A broker, usually operating from an overseas firm, will cold call an investor and propose they buy shares in a particular company.

2. To avoid being ill prepared for the nosy web-savvy investor, the share would usually have been ramped on online message boards.

3. The company they are share dealing in will probably be - a) listed on an illiquid market or, b) could be a small, unquoted company that the broker claims is planning to list

4. So, one of two things will happen - a) the shares cannot be sold as there is hardly a market for it or, b) the company will not exist at all and the broker is simply selling shares in thin air before taking the money and running (extreme case)

The firms operate from boiler room 'hotspots', such as Spain, Switzerland, Dubai, Japan, Bermuda etc. They will always have a listed address and a grand sounding name to give an air of legitimacy.

These are called 'boiler room' scams because of the highly pressurised sales technique employed by the broker. They can be forceful, persistent and highly aggressive. A common tactic is to create a sense of urgency about a stock, such as telling the investor it will explode any day so they need to invest quickly.

Additional resource : The boiler room boys are back with a new 'bargain' (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Promoters hike stake as markets melt

An article featured in the Economic Times today (here) talks about how promoters have taken advantage of the market melt-down to hike their stakes in companies. ET estimates that around 100 promoters have increased their stake in Jan-Mar 2008. The prominent names include - Arvind Mills, Bombay Dyeing, Tata Metaliks, Reliance Energy, Aditya Birla Nuvo, Ultratech, JSW Steel, Max India, Bajaj Hindusthan and UB Engineering.

Promoters buying stock in companies they founded (or are major shareholders) often goes well with the stockmarket. A possible exception is Mr. Rao of Orchid Chemicals who has been frantically searching for monies and aides to lend him money to ward off a hostile bid by Solrex. Also, read an article featured on Business Today about 10 years back on why promoters should seek to increase stakes in companies. (here)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, April 20, 2008

To NRIs with love

I came across on a fabulous presentation "Revisiting FX as an Asset Class" (366 Kb) by Stephane Targui from the Corporate and Investment Banking division of BNP Paribas. Presented were a number of FX related structured product investments which I thoroughly enjoyed. One observation, which may be of good information to NRIs and foreign citizens is the limited use of plausible ‘risks’ in the pitch. These however were conveniently stashed away as part of the disclaimer.

Lets explore two such exotic options given under short-term structures -

[1] Dual Currency Option Deposit (DCOD) – I have always felt that the DCOD is the easiest product to sell to any investor who doesn’t take the pain of thinking just a step ahead. The presentation say the following about the product (slide 8 and 9) – “a deposit offering the certainty of a boosted rate, well above the money market”, “it is a win-win situation”

Let me explain the structure in an example –

1. Assume the two underlying currencies are the US Dollar (USD) and the Indian Rupee (INR). The spot rate (USD/INR) is 45.50

2. Your investment in the structure is 100,000 USD (so the USD is the deposit currency for you and you measure your wealth in dollars, and not rupees)

3. The structure reads like, if the USD/INR rate is greater than 45.00 then you shall get 10% p.a. for the 3 month period in INR for your deposit amount i.e. Rs. 46,12,500. However, if the USD/INR rate goes below 45.00 then you shall still get 10% p.a. for the 3 month period but in USD i.e. USD 102,500.

For anyone, this might seems a rather harmless transaction as you shall always get 10% p.a. for your efforts – whichever currency you end up with. But if I put the specs in a matrix, the results are rather annoying for any investor –

[a] Note that the structure is similar to selling a put wherein your gains are limited, while your losses (on conversion of the rupees, back to dollars) can be unlimited. Notice how my overall gains become (4896.61) USD if the USD jumps up to INR 48.50. This is one aspect that the presentation misses out on. So although the pitch revloves around how FX-related investments can boost your returns, ironically it's the same movement in FX that can fetch you a negative return aswell.

[b] These structures are callable at the option of the issuer e.g. BNP Paribas. So, they can, on any fine morning tell you to round off the numbers as they are closing the product. No surprises, why they may do so.

[c] Notice, no one will say if the principal is protected or not. As you have, now deduced that although this product WILL fetch you the 10% p.a. return HOWEVER WILL NOT guarantee you protection of capital invested. Interesting concept, ain’t it?

[2] Corridor Double Knock Out Deposit (CDKOD) – Unlike the DCOD where principal is not protected, this product guarantees capital (it’s true). The product defines a range within which the FX rate (e.g. EUR/USD) should operate. E.g. the lower and upper limit of the EUR/USD is fixed at 1.22 and 1.32 (the current exchange rate is 1.27). So as long as exchange rate stays between 1.22 and 1.32, the investor would get an 8.00% p.a. interest for that day. However, if on any day the exchange rate breaches the limits then the investor will not get any interest for that day.

So the trade off matrix for investors here is [min=0.00%; max=8.00%; @ 8.00%*n/N] ;

where n = number of true observations; N = number of all observations

Here's something more I learnt about structures while going through some text on the internet -

a) 70% of all structures floated get ‘called’ within the 9 months of issuance and 90% of all structures within one-and-a-half years of issuance.

b) These structures are created as a money mobilization mechanism for investment firms. Now since they can’t just take big monies without making a challenge out of it, these deposit + derivative products are designed. The same investment firms which garner these 'high-yielding' monies make nothing less than 20% p.a. by deploying it in various other alternate investment areas …. and this has been happening for the last 200 years and more.

In a few years from now (2-3 yrs), such products would enter the Indian investment diaspora also as more companies will offer the same and hybrids of these products.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, April 19, 2008

Helios and Matheson

I bought Helios and Matheson way back in 2005 at around Rs. 180 per share. This transaction was done on the basis of some encouraging research reports

(a) Kotak PCG gave a buy call with a target of Rs. 400 (July 2005; CMP Rs. 157)

(b) ICICI DIrect Pick of the Week with a target of Rs. 454 (here)

Rs. 400 or 454 remained a distant dream for the scrip. In fact, the highest price the stock scaled was about 270 rupees. Over the last 2 years (Apr 06 to Apr 08), the stock has lost 60% in value ... and 46% in the last 1 year.

In the meantime, the EPS has increased from Rs. 13.40 in Mar-2006 to Rs. 22.29 in Mar-2007. The company is expected to deliver an EPS of 29.66 on the basis of the last 4 trailing quarters. This makes things interesting as Helios & Matheson's price-earning comes down drastically from 13.4 (Apr '06; 180/13.4), 6.3 (Apr '07; 142/22.3) to a current PE of 2.4 (72/29.7).

Over the last 3 years, the EV/EBIT ratio has only gone better in time (9.4, 5.2, est 3.4). (It's true that the enterprise value has decreased, but 'value' is quite a misnomer here .. as EV is a representation of mcap + debt - cash). The dividend payout of the firm is 35%, which gives it a useful dividend yield of 4.9%. The company has been on quite an acquisition spree having 5 M&A activities this year.

The OPM and NPM of the company has gone down. I think it's because of the acquisitions done by the company which have added to the revenue but not given an equal rise in profits. (I might be wrong, there is no data to prove/disprove this).

At a price-earning of 2.4, is Helios & Matheson worth a dip into? I'm still not sure why the stock has not been keeping track with other tier-3 IT stocks which are atleast at an 8-9 price earning.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, April 18, 2008

Behavioural Economics 101

I've always found the field of Behavioural Economics mighty fascinating. Here's enclosed some very interesting and practical applications of the same.

1. You decide to clean your car yourself to save paying the monthly 300 rupees to the car cleaner. Would you agree to clean your neighbour's car for the same 300 rupees?

2. You research a stock and you found it unworthy of a buy at 150 rupees. Today to same stock is at 1500 rupees, but is working to your buy calculations. Would you still buy it?

3. People tend to be "loss-averse" i.e. they experience more pain over a loss rather than pleasure over a gain. This is one reason why people are very uncomfortable selling stocks on which they are/have lost monies.

4. The principle of fairness is what differentiates the price you might pay for a bottle of soft-drink at a mom-and-pop store, as compared to a 4-star hotel. People feel it is fair for the 4-star hotel to charge 7-8 times more than the neighbourhood store. This is probably one reason why companies tend to lay-off people rather than reduce salaries during tough times.

5. You have a 100,000 rupees to invest in stocks. Since it's your first time, you'd invest 4000 rupees in the first month. You did a fine job of that and made a good 20% on that sum of money. The second month, you put in another 4000 and lo behold! another 22% return after month 2. ... notice that in the third month, your investible amount would have increased from 4000 to perhaps a 12000 rupees. This "mental accounting" allows people to take more risks when a string of success reaches you.

6. Often, cab and auto drivers tend to stop working for the day when they have reached their targeted income for the day. So they nonsensically, work shorter hours on rainy days and work longer hours when fares are scarce. In context, they forego an opportunity to earn more on "make-hay-while-it-shines" days. On the investing front, day-traders are like the cab drivers. The author goes on to suggest that investors should be allowed to look at their portfolio only once in 5 years.

7. The use of incentives (cue) is another factor that determines behaviour. In Ireland, a small charge (15p) was levied on plastic shopping bags. Since then, most people carry their own shopping bag to save some money. On the other hand, when in Israel a nursery imposed a fine for parents who arrived late to pick-up their children ... the response was that parents arrived more late than ever. Reason - by making the payment, the parent no longer felt guilty (in other words, they have cleaned their conscience) ... this is a great illustration of how behaviour is often different in different situation though the premise is similar.

8. Most people crib on the taxes charged by the government on one's incomes but then tax deducted at source doesn't exhibit a more mellowed emotion. Similar instances ... annual performance evaluation by companies is a hot-bed for politics, prejudice often leading to attrition of "dis-satisfied with evaluation (and not necessarily non-performing)" employees.

Behavioural Economics is a fast growing field in research and study. Why not ... people are prone to error, irrationality and emotion, and they act in ways not always consistent with maximizing their own financial well being.

References:

> Behavioural economics: seven principles for policy-makers

> Exuberance is rational (The NY Times Magazine)

This was however one instance I didn't agree to in the article. It says: A team is trailing by 2 pts in a basketball match. With 3 seconds to go and the ball with them, should they go for a 2 pt - which will tie the game and take it to overtime OR, should they go in for a 3. A 2-pointer has a 50% chance of going in, while a 3-pointer has a 33% chance of winning it. The author feels coaches often go for 2 pts as it lowers the risk of sudden loss. ... this is where I disagree because when I go in for a 2-pointer and then my chances at OT (which is again a 50:50 chance) .. I have never ever moved below a 50% chance of a victory. However, going in for a 3-pointer would give my team only a 33% chance for a victory.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Vardhman Holdings

Vardhman Holdings has a market cap is Rs. 61.92 crores (Apr-18) and yet has ...

1. Investments worth about Rs. 72.93 crores

2. Current assets of Rs. 22.54 crores

3. Zero debt in it's books.

As I couldn't locate the annual report for FY07, I'm using the FY06 report and some published data (here). Investments in FY06 and FY07, remain constant at Rs 72.93 crores. A bulk of this investment is in Mahavir Spinning (name changed to Vardhman Textiles) amounting to 15,402,598 shares. At the current price of Rs. 119 (Apr 18), Vardhman's Holding in Vardhman textiles amounts to Rs. 183 crores. Traditionally, holding companies are never valued over 60% of the current value of individual companies. At 61 / 183 crores, the market is pegging the discount at 33% .. which is a bit low.

The dividend proposed by Vardhman Textiles last year was 40% (Rs. 4 per share). This amounts to a dividend income of Rs. 6.2 crores for the holding company on the basis of 1.54 crore shares. The company's dividend payout for the last 5 years are 42%, 45%, 45%, 40% and 40%. I dont expect this to change much. The dividend value is a bit above 10% of the holding company's m-cap.

The current assets of the holding company are at 22.54 crores. With zero debt and 96% of the CA in cash/bank deposit ... the reconstructed NCAV calculates to Rs. 70.65 per share (36% of m-cap)

Hence, from an asset valuation :

Shares in Vardhman Textiles = Rs. 183 crores

Net current assets = Rs. 22.5 crores

Total = Rs. 205.5 crores

Current m-cap = Rs. 61 crores

Hence, m-cap to asset value = 29.7%

Or, available discount = 70.3%

There has been some bulk deal activity at the Rs 150-160 range in the stock. Else, mutual funds are pretty much inactive with this counter. Ravi Purohit wrote a blog around this (and other holding companies) sometime back (here).

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Ruchi Soya Industries

I bought shares in Ruchi Soya day before at 87 rupees. Ruchi Soya is not a value investors bet but a growth investors'.

Ruchi Soya operates in a promising sector. As the 4th largest consumer yet a dismal 12 kgs of per capita consumption per annum, the edible oil industry is slated to rise with increased demand. For more information on the industry, read the corporate presentation available at Ruchi Soya's website (here, slides 10-15, pdf, 573 Kb).

Ruchi Soya is an excellent franchise. Over 10,000 crores in sales makes Ruchi Soya the largest integrated oilseed solvent extraction company, the biggest importers & refiners of edible oils in India and the biggest exporter of soya meal and lecithin. Ruchi Soya accounts for 12% of Indian edible oil consumption.

The company has done well in the branded edible oil segment too and has taken up branding in a big way. Nutrela (soya chunks, granules, soya flour) is the largest selling soya foods brand in the country today. Additionally, they have Nutrela Soyumm (Soyabean Oil), Ruchi Gold (Palmoline Oil), Sunrich (Sunflower Oil) and Mandap (Mustard Oil). New healthy oil variants like Nutrela Vitamin Sunflower oil and Nutrela Groundnut oil are also on offer. Their latest product is N-rich, a soya based nutritional drink.

1. The company will close FY08 at annual sales of Rs. 10,200 crs. The company has shown a 4-yr CAGR of 30% . The edible oil industry in India is slated to grow to 33% per annum. Given Ruchi Soya's penetration in the market, their sales growth should atleast be 15% next year.

2. Ruchi Soya's net profit margins have increased each year by 10 bps (0.8% in 2003 to 1.3% in 2008). I estimate a closing profit of Rs. 130 crores this year which is 30% higher than last year. On the operating margins front, Ruchi Soya has improved from 2.3% in 2003 to 3.2% now .. improving each year.

3. Adjusted for the 5:1 stock split, the EPS has increased each year (2.5, 3.2, 4.1, 5.5, 5.5, 7.1). I have further tracked the price-earning over these years. On Mar-31st of 2005, 06, 07, 08 .. the PE of the stock has been pretty consistent - 11.0, 13.1, 11.8, 11.5. At the current price of 90 (Apr 17), Ruchi Soya is valued at a price earning of 12.6.

From an asset view, Ruchi Soya is not the best bet for a value investor. A negative NCAV and a high debt-equity ratio may put many off. I picked this stock from an earnings and franchise perspective. A big, bulky, difficult to enter business, in an organised market of 10, growing at 30% in an industry growing at 30% is probably a bet .. but hopefully an educated one.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, April 16, 2008

'Value Investing' by Prof. Greenwald

Professor Bakshi has uploaded Professor Bruce Greenwald's notes on his website (here). Prof. Greenwald from the Columbia Business School, was in Mumbai to deliver a talk titled, "Value Investing Frameworks and Business Analytics" (post by Prof. Bakshi)

In an article published in The Motley Fool, Prof. Greenwald shared his learning in a 5-part series. I've enclosed some parts of these in the post.

Part 1 : VALUE INVESTING 101 (here)

1. Simple stock search strategy : go for ugly, traded-down, cheap, boring -- as opposed to glamorous, respectable, lottery-ticket type and prominent stocks.

2. Develop a valuation technology : The Graham technology is starting with the most reliable information, which is asset value, then looking at the second-most reliable information, which is current earnings -- with all the appropriate adjustments and getting an earnings-power value -- and then looking at those two and see what they tell you about the extent to which you are buying a franchise, which is value in excess of assets. And then, only then, looking at the growth.

3. Patience : You have to have confidence in your valuation. If nothing has changed about the underlying value of the company, then if it's a good stock at 8, then it's a better stock at 4.

Part 2 : TO HOLD CASH OR NOT? (here)

4. Valuations may be high but in general, don't just throw away the market : If you're an equity manager - what's your risk? It's deviation from the market. So if you have nothing to do, you might as well minimize risk and buy a full market portfolio, and that's that.

5. Determine your risk tolerance : Look at it this way, if you're being given institutional funds that the institution wants to allocate to equity, you got a different risk profile on the returns on those funds than if you're managing a family's entire wealth where they care about absolute returns.

Part 3 : THE ART OF SHORTING (here)

6. One of the most restrictive clauses of the value discipline is 'no short selling' : Value investors are nervous about short selling for two reasons.

a) Tax treatment of short gains

b) As the stock goes up and the short goes against you, your risk goes up as opposed to going down. (I think the professor means that as the price of the stock goes even down, your opportunity should increase such that you can accumulate more. But you are on a long position and when the stock goes down, the shorting turns the advantage into a loss).

7. In shorts, much more than longs, you obviously want to look for a catalyst : This can be a restructuring or an earnings disappointment etc.

Part Four : IDENTIFYING FRANCHISES (here)

8. The way to think of growth in the simplest possible terms is growth requires investment : Everybody on Wall Street sort of talks about scalability and growth without investment, but if you look at the history of any growing firm, the amount of capital they put in grows with the growth in the firm. It just tends not to be scalable.

9. A franchise : is something that you can do that your competitors can't. And there are really only three possibilities.

a) It is increasingly rare in a rapidly changing world is that I've got technology that they can't match. That I can do it at a lower cost than they can. Those things go away very quickly, because people can copy technology. It's usually only in very complicated process industries that you have -- and some pharmaceuticals where you're patent protected, that you have technological advantages.

b) Customer captivity is probably going down a little. The Internet makes it very easy to compare prices. It's the enemy of profitability in that sense. But if you look at repeat purchase behavior, it probably hasn't changed all that much.

c) Can't match my cost, even though they've got the same cost structure, because I have economies of scale and they don't.

Part 5 : THE ONE INVESTOR TO BET ON (here)

10. If I were going to start off as an investor, I would start with Ben Graham's book, The Intelligent Investor. It's not because he lays out all the really good ideas that he had perfectly, but it's just a terrific introduction to the attitude it takes to be a successful investor.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Tuesday, April 15, 2008

The most published author in the world

Philip M. Parker has written a lot of books .. 200,000 of them. However it may not be accurate to call him an author, as he is more of a compiler. Having developed computer algorithms that collect publicly available information on a subject and aided by 60 to 70 computers plus 6-7 programmers, Parker turns the results into a book. These books are print-on-demand, so only when a customer orders them are they printed. And yet, these books are retailed on Amazon.com

Now Parker is laying the groundwork for a romantic novel, again using his trusted scribes i.e. computer algorithms. Read the entire article (here). Or if you care to watch the video (here).

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

SRF Limited

Now, this is one stock that puzzles me.

1. SRF, over the last 4 quarters, has made an after-tax profit of about 200 crores. Yet, the entire company is available at just Rs. 730 crores (Apr 11)

2. The company makes over 3 times of what it made exactly 3 yrs back. The equity structure has not changed much in these years ... and yet, money invested on April 11th, 2005 would, in 3 years, have yeilded a return of just 2.1% (excl dividends)

3. The book value of SRF is today higher than the CMP. In the last 3 years, this has never happened.

4. The stock is available at a PE of 3.42. While the textile industry is down, it's less profitable peers are at an average PE of 7.

Heard anything? Or is it just another value investing candidate?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Dilbert and mental models

An excellent post on the Dilbert blog. The post (here) is a message to all company Boards that they should look for a CEO every two years such that they might get someone equally qualified, but cheaper. Dont miss out some of the comments given in the link.

Some observations from a Board member's point of view -

1. Lower the cost, lower the quality

"This may not be true for lower or middle management but should be true for the top management. A person who comes cheap, shows a lower status in front of the Board."

2. CEO compensation follows the return-risk function.

"No, not the 'higher the risk, higher the return' model ... but the 'higher the return, lower the risk' paradigm (see my post here). Thus, a CEO who gets a higher compensation will ensure that business risks never exceed an acceptable range. (probably)"

3. The Board doesnt want to be the fall guy

"If an inexpensive CEO is recruited by the Board (over an expensive one) and this CEO falls to deliver .. the Board will face the music. The allegation will be that the board tried to penny-pinch, while a few more dollars wouldnt have much difference to the profits of the company."

4. The league

"The Board consists of presidents and CEOs of multi-million corporations. They would prefer candidates who earn close to their compensation irrespective of the quality."

Ah .. too much rambling .. I'm off to sleep now !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Monday, April 14, 2008

The economics of a tip

Most trading in the Indian equity markets still happen on tips, news and advice from brokers. The stock market absolutely craves tip-o-logy as it ensures that the greater fool theory works fine. For a value investor, these tips are suicide ... unresearched and risk-heavy. As Wareen Buffett once said, "Even an insider's tip can be wrong".

Interestingly, the only person who is absolutely sure to gain from a tip is the "tip giver". Take a look at this -

Day 1

You wake up and go through your rather extensive phone book. There are exactly 1000 mobile numbers. Not worrying about the day's valuations or what Udayan Mukherjee has to say on CNBC TV18 or the latest scoop in moneycontrol.com ... you start by neatly dividing the stock of mobile numbers in two equal parts. Then you start the rather laborious exercise of sending a message to the first 500 people - "Reliance Industries will go up today" and to the other 500 people - "Reliance Industries will go down today". Your cost = 1000 rupees (Re.1 being the charge of an SMS)

Day 2

Another wonderful morning. You pick up the morning paper to find the Reliance stock to have shot up. You look to the skies, say a small pray for the people who got your prediction wrong and get about your work for the day. You divide the remaining stock of 500 people who got the right 'advice' into two parts. To one part (250) you sms - "Infosys is definitely up today" and to the remaining 250 - "Infosys is surely down today". Your cost = 500 rupees (total cost = 1500)

Day 3

Infosys seems to have gone down today.. these cut in spends in the US are creating some havoc, you say and get down to business. 250 correct tips (for two days) get cut in 125 and 125. To one half, Wipro to go up and to the other, Wipro to go down. Cost for the day = 250 rupees

Day 4125 is broken into 62/62. Now HLL is at stake, and you have me (the famous stock analyst) to give you your daily sms stock tip. Cost = 125; total cost = 1875

Day 5

By now these 62 people who got all 4 tips correct would be really going nuts. Some might have also invested using my tips while some others would be really scouting for some money because they now have this amazing stock analyst who gives correct predictions after another. For them equity market investing was never so much fun and easy.

Only this time it's pay-back time. In return of these wonderful tips, I ask for a paltry sum of rupees 10 for the next tip. Let assume the 62 of them pay up 10 rupees. Thats a cost of 62 for me (for the sms) but an earning of 620 rupees. Total loss is now down to 1,317 rupees. Again we do the 31/31 split.

Day 631 is split as 16/16 (rounding off numbers here for illustration purposes). This time I charge a premium of 20 rupees because its 5 correct tips in a row.

Day 7, day 8, day 9 and day 10

16 = 8/8; 8= 4/4; 4=2/2; 2=1/1

Premiums also increase to 30, 40, 50 and 60 rupees. I am currently sitting on a cumulative profit of 362 rupees.

Day 11

Last day at work. I pick up my phone for a rather lackluster day, flip a coin and sms the one lonely fellow my tip of the day (boy, this guys must have gone real crazy by now). He must be eyeing an expensive lunch table with Warren Buffett. Not even, Buffett might have got 11 bets right in 11 straight days .. afterall, he is a lame value investor.

At the end of 11 days of work the tip giver has a net PROFIT of 431 rupees.

Scenarios -

a) Had I started the share-tip collection in the fourth iteration itself, I would have made profit of 2921.

b) And if I had charged a premium of 10 rupees throughout from the fourth iteration - i would have gained 491 rupees.

The king of torts may ask - "Is it legal?". Well what makes any aspect of this illegal? The people receiving the tip have a choice to act or not act on it. Consideration is being taken for a service rendered - i.e. pain-staking research of Indian equities.

Excellent money making machine, eh? (Q.E.D.)

If you like this content, then do check out my new blog on investing and stock markets for lots more information on the Indian equity markets

(Story available on my previous blog. Just went down memory lane !)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Sunday, April 13, 2008

When regulations attack (internet radio)

Nothing better than starting Sunday morning with some music. The first entry in a google search (here) led me to http://www.pandora.com/.

Pandora is an automated music recommendation and Internet radio service created by the Music Genome Project. Users enter a song or artist that they enjoy, and the service responds by playing selections that are musically similar. Users provide feedback on the individual song choices — approval or disapproval — which Pandora takes into account for future selections.

Here's the latest. Pandora doesn't allow access to listeners outside the United States. This is not the case because of some security threat. Instead Pandora has sited 'licensing constraints' as the reason for disallowing access. And so ... I digged further.

On May 1, 2007, the United States Copyright Royalty Board approved a rate increase in the royalties payable to performers of recorded works broadcast on the internet. The rates include a minimum fee of $500 (U.S.) per year, per channel, with escalating fees for each song played. The decision is retroactive, so for 2006 the applicable fee would be $0.0008 per performance. A performance is defined as streaming one song to one listener, i.e. a webcaster with 10,000 listeners would pay 10,000 times the going rate for every streamed song. The fee increases in increments each year, which amounts to $0.0019 per song by 2010.

The current revenue model of most Internet radio stations is - 1) Advertising (which is often a %age of the number of listeners) and 2) Subscription (which is not very high as there are enough free alternatives for listeners). On the cost side, until now most small webcasters have paid royalties calculated as a percentage of revenue or, pay per song irrespective of the number of listeners. Under this new rule, those outfits will have to pay on a per-song, per-listener basis. Webcasters say, royalties on a per song-per listener basis may exceed the total revenues of the webstation.

On the surface, these amounts of $0.0014 may not sound terribly onerous, but they could add up quickly. For instance, if 10,000 people listened to fifteen songs an hour for 24 hours on an Internet-only station, the fee would be over $5,000 for just one day.

Understanding regulations is crucial before taking an investment decision. Take Reliance Fresh for example. They wouldn't have imagined a strong backlash by vegetable vendors in UP. While the backlash was bearable, the UP government coming to the support of the vendors (with a restrictive clause) was reason enough for Reliance Fresh downing the shutters on 10 stores there. Similar forays intended by the company in the dairy processing segment might also get some restrictive attention. As value investors, we despise these things. Aptly puts : almost all surprises are bad.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Lloyd Electric and Engineering Limited

Lloyd Electric and Engineering Limited is India's leading air conditioner coil manufacturer and commands a 60% market share. Lack of organised competitors in it's business gives LEEL good business from branded A/c manufacturers like Blue Star, Voltas and LG. Additionally, the company has started contract manufacturing of air-conditioners for Samsung and Haier. The A/c industry has been growing at a CAGR of 30% for some years and a recent report by IBEF has projected the industry to grow at 32-35% (slide 8, here, pdf, 288 Kb).

1. The comany has seen sales grow at a 3-yr CAGR of 43% with FY07 sales closing at Rs. 497 crores . This year LEEL is expected to close at Rs. 630 crores in sales (26% over LY). Given the projections by IBEF, I expect LEEL to continue with a 30% sales growth.

2. Profits too have risen over the years. Last year, LEEL closed at a PAT of 42.96 crs. This year, I expect them to close the year at Rs. 60 crs.

3. LEEL's OPM has been increasing through the year moving (8.2%, 9.0%, 11.6%, 12.6%). This year too, they will show an OPM of 12.7%. However, we must note here that material cost accounts for 84% of the sales value. Any change in that, like rising copper prices, can hamper the operating margins. In such a scenario, it is important to understand if the company can pass on these costs to the manufacturer. Currently, it seems passing of costs will not be a problem.

4. EPS has grown over the years (1.63, 2.1, 6.2, 10.4, 13.9). FY08 expected EPS is 19.3. If that comes out correct and at a CMP of 99 rupees (11-Apr), we are looking at a price-earning ratio of 5.11.

5. Book value of LEEL is at 96.48 (Mar-07). Price/BV is hence at 1.04.

6. Peter Lynch in an excellent article written in 1989 (here) wrote about comparing P/E ratios over the year. (read the article anyway, Lynch talks extensively about his stock picking methodology). Since I couldn't figure out EPS on a quarterly basis for all years, I used Mar-31 data over a period of 6 years including my FY08 projections. The PE ratios over the years on Mar-31, were : 1.22, 2.61, 11.5, 14.5, 10.1 and 4.6. The stock has traditionally maintained a PE of just over 10 for the last 3 years.

Given the consistency of results over all quarters in FY08, I extrapolated the growth in EPS over each quarter and was able to calculate the PE ratio at 4 dates n FY08. This comes out to : 12.1 (Jun-31) / 10.7 (Sep-31) / 11.4 (Dec-31) / 4.6 (Mar-31).

7. The free cash flow of the firm is negative for FY07 on account of a huge capex on account of a plant in Dehradun manufacturing coils and airconditioners. There seems to be no marked capex for FY2008. (annual report here, pdf, 486 Kb)

8. Not too many mutual funds are lapping up shares of LEEL. It seems they too are bit by a paralysis of not investing in mid-cap and small-cap stocks. Even world investors are now saying that the Indian equity market is available at excellent valuations.

So, here we have a company which has - a) a very dull, obscure name, b) is a leader in it's segment with a 60% market share, c) has very few organised competitors, d) operates in an industry growing at 30% per annum, e) is growing at over 30% per annum in sales and profits, f) offers a P/E of 5.1 which is an aberration from it's normal levels of 10-11.

I found three research reports on LEEL :

SKP Securities (Oct 2007, CMP: 172, Target: 317, 18 months, here)

Angel Broking (Sep 2007, CMP: 187, Target: 238, 12 months, here)

PNR Securities (Dec 2007, CMP: 178, Target: 240, 12 months, I have the report)

LEEL is available at attractive valuations. I'd suggest a BUY !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Saturday, April 12, 2008

An article gone wrong

Fortune published an article in August 2000 with a bold title : "10 Stocks To Last The Decade". The article made an assessment of major trends that'll shape the next ten years .. and how their pick of 10 stocks are at the cutting edge of this change. In other words, Fortune advised investors to really invest i.e. build a buy-and-forget portfolio. Unfortunately one of these ten companies did not survive even 4 years since the article was published.

These 10 blockbuster companies, handpicked for long term investment, listed in the article were :

Broadcom

Charles Schwab

Enron

Genentech

Morgan Stanley

Nokia

Nortel Networks

Oracle

Univision

Viacom

And here are the results from the stock market, 7+ years since that article was published (here):

As a portfolio, these 10 stocks have eroded shareholder's wealth by a whooping 53% in a period of 7 years. The valuations of most stocks were faulty and were picked during periods of extreme optimism in the stock exchanges. Trading in these stocks was heavy and the price-earning multiple of each of these stocks (barring 1) was over 50. Imagine taking these stocks to Benjamin Graham or Warren Buffett for an assessment ! (while the first would have been furious, the latter would have been puzzled at the business which he didnt quite understand)

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Investors emotive cycle and the credit crisis

In high school, we were introduced to economics and the cycle of Growth, Maturity, Slowdown, Depression & Revival. For centuries most businesses and industries have treaded from peaks to troughs. An investor's job is to identify the current cycle state of those businesses at the stock market and take an informed decision to invest or divest based on the valuations.

But these patterns are not just applicable for businesses or sectors. Infact, individual human behavior isn't any different at all. There are 5 behaviors that best describe an investor's state in the muddled financial markets - Greed, Disbelief, Denial, Fear, Anger.

While the first four are very prominent phases during financial crises, 'anger' is one behavior that seems to have taken over investors. George Soros is angry with the Federal Reserves; the Feds are livid over the PEs and hedge funds who bought mortgage-backed securities; these institutions are hurling abuses at rating agencies who incorrectly rated those tranches; the rating agencies are furious at the lack of data provided by banks offering these assets; these banks are blaming mortgage consumers; and the consumers blaming these banks for over-leveraging them; the banks are crying because the Feds increased interest rates thereby lowering prices of housing ... the blame game never ends. Everyone is angry !

Anger occurs when one's trust is violated. But who is to be blamed for this? Look at it this way, you wouldn't lend money to the nice family that lives 3 houses down the road. But you are comfortable lending it to an unregulated institution called a hedge fund. You have placed your trust (and money) on a stranger.

As an article in the Economist puts it (here), the financial market mostly works on trust. Regulators have to trust financial institutions for they cannot predict the peril of a financial idea before the peril has happened. They have to let markets develop. Incidentally, the credit crisis have called for a much higher participation by regulators. As Josef Ackermann, CEO of Deutsche Bank aptly puts it, "I no longer believe in the market's self-healing power".

While risk is always there while investing, as value investors our approach should be to minimize the impact of these risks. Like Charlie Munger who says, "build a 30,000 ton bridge for a 10,000 ton truck". He and Warren Buffett have also held that they are nervous investing in businesses which they dont understand. The mortgage crisis was similar because the complicated structures made it difficult to understand the nature and quality of the asset .. even today banks ad the central banks are not sure of the extent of the damage .. some say it can be as high as USD 30 trillion.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Friday, April 11, 2008

The paralysis of a market crash

I couldnt help read and re-read Rob Arnott's excellent assessment of human behaviour : When there happens a crash, you have enough uncertainty .. that it paralyses the people who might otherwise take the other side of your trade.

When the Indian stock markets came down from 21,000 to 18,000 levels (Fall 1), a number of individual investors couldnt pass for the wonderful opportunity to purchase their favourite stocks at a bargain. It's probable that you too were able to spot a stock available at much cheaper levels and would have invested a significant amount of cash. The valuations did seem very good then.

However, when the markets go down even further (from 18,000 to 15,000 (Fall 2)) - the same investors who invested in Fall 1, almost refused to invest further. A paralysis of sorts struck these investors ! They hibernate and only show some activity when the market approaches the Fall 1 levels. By this time, they lose a fantastic opportunity to buy ridiculously inexpensive value stocks.

When asked a reason for not investing at these levels, investors oft say : "I'm waiting for the market to settle down". Experts blame this behaviour on the "recency bias". The recency bias means that investors will put too much weight on recent experiences and trends to determine the future. This is what happened during Fall 2. When the stock market tanked the second time, the recency bias set with most investors and fear set in. During a period of fear, taking actions is very difficult and hence the paralysis.

Ofcourse, the lag between the great crash (Fall 2) and restoration of investor confidence (Fall 1) is often the little window of opportunity that value investors tend to capitalise on. The last three months have provided a value investing opportunity for the Indian stock market.

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Pyramid Saimira enters music publishing

Some people must have frowned at this headline (here). Pyramid Saimira is entering an industry which grew by 1% in 2007 and holds a CAGR of merely 3% for the last three years. And by S Saminathan 's (CEO and MD) own admission, retail sale of music is minuscule and, music on the Internet & mobile phones generate more revenues than physical stores. This seems quite an ill-planned venture by the mid-cap company. From a value investor's understanding, there are evidences of destruction of shareholder wealth.

Interestingly, this announcement by Pyramid Saimira came one day after, Apple iTunes went past Wal-Mart in music sales in the US (here). A survey in the US now puts iTunes market share at 19% while Wal-mart music sales are 15%, for the first 2 months of the year. iTunes has sold over 4 billion songs in MP3 digital format to about 50 million customers. Some further digging shows an even more interesting trend in the UK - sales of digital singles jumped 47% last year to reach 78 million while the physical CD singles sales tumbled by 42% to 6.6 million. In other words, 90% of all singles sales are now made online.

Additionally, David Bryne in an excellent article in the Wired magazine (here), writes about the music business. Two interesting things, he says in that article -

1. Today less music is being purchased and most of what's being purchased is digital

It will be interesting to see Pyramid Saimira's music foray. My best guess is that it'll use up previous cash and resources in the company, than the return (on investment) it can generate. The Indian music industry is certainly not in a growth phase and is facing problems similar to anywhere around the world. Entering a non-growth, competitive industry with a secondary business model (in case of non-digital) ... although the Indian equity market may commend the move, it does not get my vote for smart business !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Thursday, April 10, 2008

Sarda Energy and Minerals

Ever heard of this stock?

I was surprised to find that Reliance Long Term Equity fund holds over 3% of the m-cap of this company (here, Mar-31). And although this is the only stock which has any stake of repute in the company ... on the face of it, the stock seems quite attractive.

a) Sales have increased in each of the last 5 quarter (Dec-06 : 54 crs, Dec-07 : 163 crs). So have net profits (Dec-06 : 2 crs, Dec-07 : 58 crs)

b) EPS has improved every quarter (1.76, 5.66, 7.07, 10.79)

c) I expect the company to end the year with a profit of Rs. 95 crs which will mean an annual EPS of 27.90. The corresponding PE ratio will be 12 .. a very decent number.

d) The stock has recently been beaten down from Rs. 650 levels to current levels of Rs. 310 per share (9 Apr)

I am not able to find the annual report of the company for a check on it's balance sheet and profit & loss account. Co-incidentally, India Infoline came out with an analyst report about the company on April 3rd, 2008. The report was quite flattering !

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

ICICI Direct stock picks

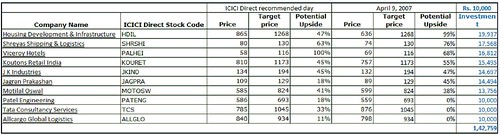

My yahoo mail account gleefully popped out the latest ICICI Direct recommendation list. (here) Over time I've observed that the ICICI Direct stock picks are pretty efficient and 80% of the times, give the right result (read: positive). Since some of these recommendations were given in Feb and Mar, I updated the prices and sorted the list to identify their best picks for mid-term investing (12-15 months). The new chart is enclosed below.

Click on the picture to enlarge

The column in the extreme right indicates what happens if you were to put up 10,000 rupees against each stock and follow the published time frame of 12-15 months. If the picks were right then you would end with a return of 48.7%.

This allows room for some sensitivity. Lets assume that 70% of the picks will be right i.e. when the price reaches the target, we will sell the stock at that price. Correspondingly, for the 30% picks that'll go wrong, lets assume zero price appreciation over time.

Case 1: Our top 3 stocks (sorted by appreciation) go wrong ... In this case, our 15-month return will only be 24.4%

Case 2: And if our bottom 3 stocks (sorted by appreciation) go wrong ... our 15-month return will be 42.7%

Hence, our range of 15-month returns on the basis of ICICI Direct recommendations lies between 24.4% to 42.7%.

Instead, had we just picked the top 5 stocks from this list, our returns estimate jumps up to 69.0%. Correspondingly, the returns range would hover between 34.1% and 48.6% on the basis of a 60:40 right-wrong ratio. An average return of 40% on the Indian equity market factoring a 30% wrongness factor isn't bad, eh?

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Wednesday, April 9, 2008

A way with words

On April 5, Microsoft Inc. shot a strongly worded letter to Yahoo's board of directors with a deadline to negotiate the terms of the deal (here). Industry observers are reading high into Microsoft's desperate attempts to enter the online advertising stream and additionally their disappointment at Yahoo's unconfirmed talks with Google, AOL and other internet properties.

Yahoo's response to this letter was posted on their website on April 7. (here). In that letter, Yahoo took a good shot at all Microsoft allegations surrounding their right to look for strategic alternatives to maximize shareholder value, potential upside on the business front over a 3 year period, anti-trust regulatory investigations and their stoic approach any future threats.

One of the better verbal battles, I've come across involved an American and an Indian company. The letters make for a fantastic reading.

The Indian Hotels Company in Nov 2007 had shot off a proposal to the Orient Express Hotel (where the former was the largest shareholder). This proposal was rebuffed by Orient Express twice, then followed by a acrimonious letter by Orient Express CEO, Paul White dated 10 Dec, 2007. A copy of the letter is enclosed (here).

The one line which must have erked IHCL : "We believe any association of our luxury brands and properties with your brands and properties would result in a reduction in the value of our brands and of our business and would likely lead to erosion in the RevPar premiums currently achieved by our properties."

On 19 Dec 2007, IHCL reverted with a perfect reply (here). The last paragraph of the letter should be read and re-read by every Indian.

It reads : "Taj Hotels is a proud Indian company, and it will persevere with its global expansion strategy. Indian companies will continue to play a meaningful role in the ongoing global economic integration and in that environment will take their rightful place in the international arena. Enterprises and individuals must recognize and adapt to these fundamental economic changes. We believe that those with a fossilized frame of mind risk being marginalized."

Bookmark this post:blogger tutorials

Social Bookmarking Blogger Widget |

Short term and long term choices

Economists at the London School of Economics got some students into the lab. They got them to fill in a survey (the survey was basically a decoy). Then they said to the students ‘Thank you for filling in the survey, as a token of our appreciation, would you like a snack? What would you like: fruit, or chocolate?’ The students, being members of the human race, mostly chose chocolate.

In another variant of the experiment, the economists got the students to fill in the survey and said ‘Thank you very much, next week, we’ll bring you a snack. What would you like next week, fruit or chocolate?’ And the students said ‘Fruit sounds nice, thank you very much’. The next week they would turn up with the fruit and say ‘here’s the fruit you asked for … are you sure you wouldn’t like chocolate?’ At which point many students would switch to chocolate.

What happened here?